Maricopa County Property Tax Records

Maricopa County property tax records are kept by two main offices that work together to assess land and collect payments. The county assessor sets values on more than 1.8 million parcels, while the treasurer sends bills and takes payments for over 1,800 tax districts. You can search these records online for free. Both offices are in downtown Phoenix at 301 W Jefferson Street. The assessor tracks who owns each parcel, what it is worth, and how it is classified. The treasurer shows what you owe, when bills are due, and your full payment history. Most record searches take just a few minutes on the county websites.

Maricopa County Property Tax Quick Facts

Maricopa County Assessor Property Records

The Maricopa County Assessor keeps records on every taxable parcel in the county. This office values land and buildings to set the tax base. Each year the assessor mails a Notice of Value to property owners. This notice shows two key numbers. The Full Cash Value is what the property would sell for. The Limited Property Value is used to figure out your tax bill.

You can reach the assessor at 602-506-3406. The main office is at 301 W Jefferson Street in Phoenix, AZ 85003. Hours are Monday through Friday from 8 a.m. to 5 p.m. The office now sends electronic notices if you sign up for eNotices on their site. This gets your value notice to you faster and cuts down on lost mail. The assessor also has a Business Personal Property Unit at 602-506-3386 or you can email ASR-BPP-PubAsst@maricopa.gov with questions about commercial property filings.

The assessor website offers a parcel search tool at no cost. Type in an address or owner name to pull up records. You can see lot size, building square footage, year built, and sale history. Maps show exact parcel lines. The site also lists any exemptions on the property and what class it falls under for tax purposes.

The Maricopa County Assessor home page provides direct links to search tools and forms you may need.

Business owners should know about the personal property exemption. Starting in Tax Year 2026, the exemption will jump to $500,000. This means many small businesses will owe no tax on equipment and fixtures. The Business Property Statement must be filed by April 1 each year with the assessor if your equipment value is above the exemption amount.

Maricopa County Property Tax Maps

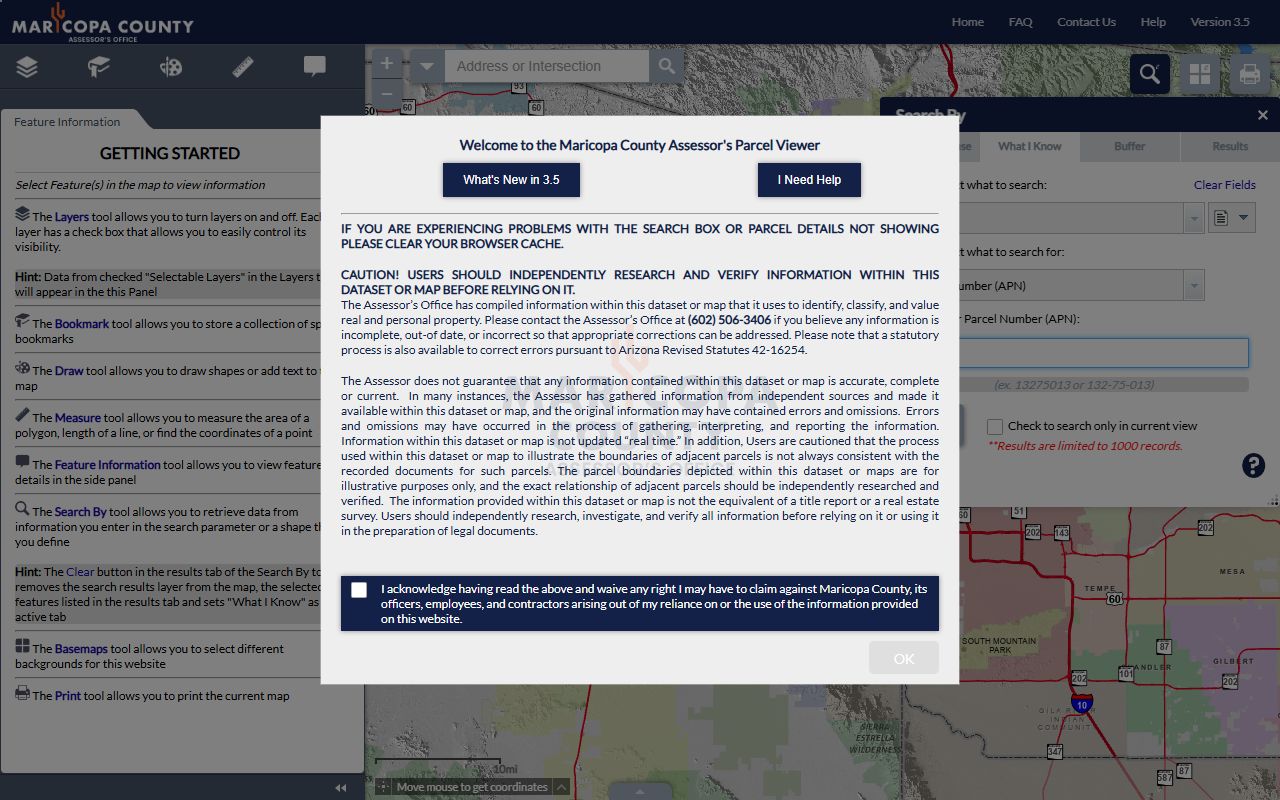

The assessor runs an interactive GIS map viewer that shows every parcel in the county. You can zoom in on any area to see lot lines and parcel numbers. Click on a parcel to get basic info like owner name, address, and current values. The map tool is free to use and works on most web browsers.

Check out the Maricopa County GIS Parcel Viewer to explore property boundaries and find parcel numbers for your search.

The map tool helps when you need to find a parcel number but only know the general location. It also shows neighboring parcels so you can compare values in your area. Surveyors, real estate agents, and title companies use this tool daily. Homeowners find it useful for checking lot dimensions before building a fence or adding a room.

Maricopa County Treasurer Tax Records

The Maricopa County Treasurer handles all property tax billing and collection. This office sends out tax statements each September. Bills show the amount due for the tax year and list all the districts that get a share of your payment. Schools often get the biggest slice. Fire districts, community colleges, and special improvement areas also show up on the bill.

You can call the treasurer at 602-506-8511. The office is at 301 W Jefferson St, Suite 100, Phoenix AZ 85003. Mail payments go to PO Box 52133, Phoenix AZ 85072-2133. Office hours are Monday through Friday from 8 a.m. to 5 p.m. The website lets you search your tax bill and see payment history any time of day.

Payment options give you some choices. E-check has no fee, which makes it the cheapest way to pay. Debit cards cost 1.80% of the payment. Credit cards run 2.25%, and that includes Visa, MasterCard, Discover, and American Express. Digital wallets like PayPal, Venmo, Apple Pay, and Google Pay also work but charge 2.25% as well. Pick the method that fits your budget best.

Note: Always keep your payment receipt until the next tax year in case of any billing questions.

Maricopa County Tax Payment Deadlines

Property taxes in Maricopa County follow a set schedule each year. Tax bills go out in September. You can pay in two halves or all at once. The first half is due October 1. It turns delinquent if not paid by November 3. The second half is due March 1 and goes delinquent after May 1. If you want to pay the whole year, do it by December 31 to stay clear of any interest charges.

Missing a deadline hurts. Interest starts at 16% per year once you pass the due date. That works out to about 1.33% per month. On a $3,000 tax bill, you would owe an extra $40 for just one month late. Two months late adds another $40. It piles up fast. The county does not send reminders when deadlines approach, so mark your calendar and check your bill in September.

Key dates to remember:

- October 1: First half payment due

- November 3: First half becomes delinquent

- December 31: Full year payment deadline

- March 1: Second half payment due

- May 1: Second half becomes delinquent

The treasurer website shows if your taxes are current or past due. Check it before a deadline to make sure your payment went through. Bounced checks or failed card payments can leave you delinquent even if you thought you paid on time.

Maricopa County Property Tax Lien Sales

When property taxes go unpaid for a full year, the county puts a lien on the property. These liens get sold at auction each February. Investors buy the liens and earn interest as the owner pays off the debt. The interest rate in Arizona is 16% per year. If the owner never pays, the lien holder can eventually take the property.

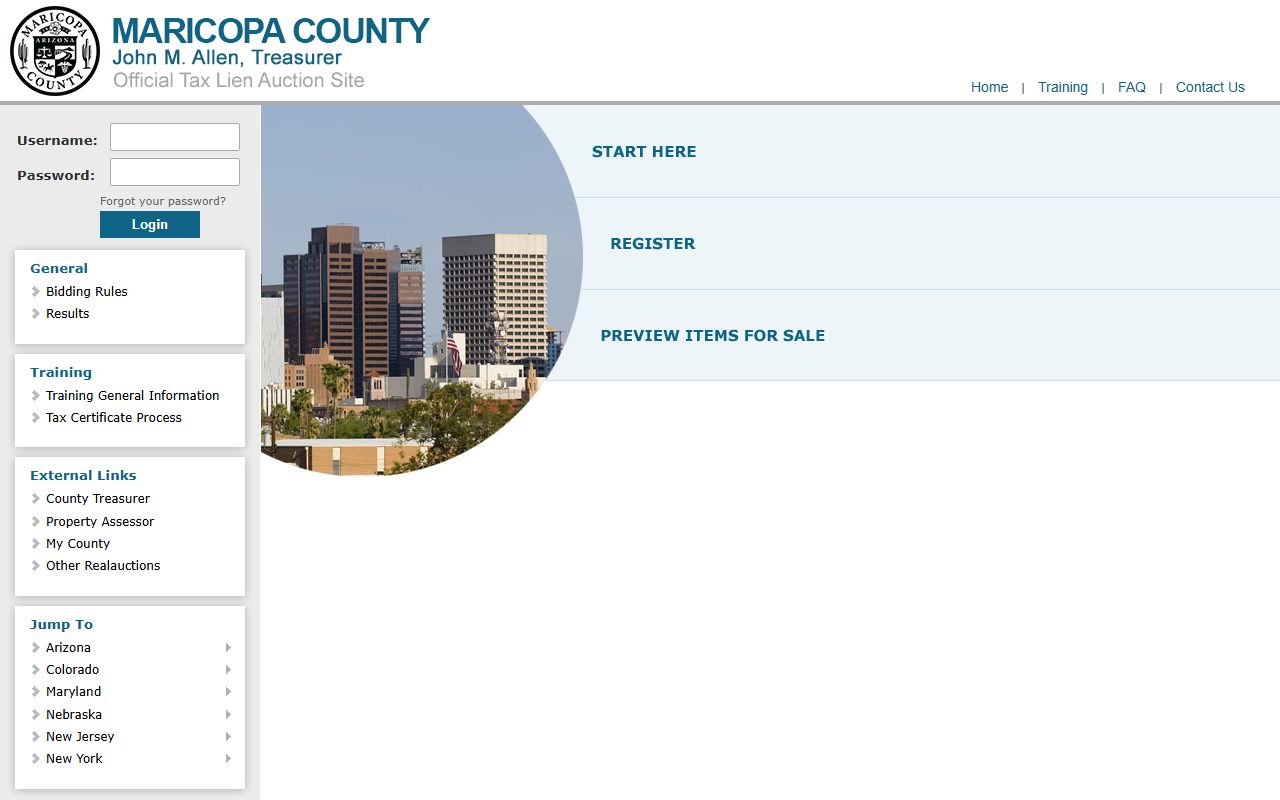

The Maricopa County Tax Lien Sale portal lists all properties with delinquent taxes available at the next auction.

You can search the lien sale site to see what properties are on the list. The site shows parcel numbers, addresses, and amounts owed. Some investors buy liens as a way to earn high interest. Others hope to get property cheap if the owner walks away. Either way, the auction happens online and anyone can register to bid.

Homeowners who fall behind on taxes should act fast. Once your property goes to auction, getting it back costs more. You must pay the full lien amount plus interest plus fees. The county gives owners time to redeem the property, but the clock starts ticking once the lien sells.

Maricopa County Property Tax Appeals

If you think your property is valued too high, you can file an appeal. Start with the assessor. You have 60 days from when the Notice of Value was mailed to file. Use ADOR Form 82130 for real property or Form 82530 for business personal property. The assessor reviews your claim and may agree to lower the value.

What if the assessor says no? You have two paths. File with the County Board of Equalization within 25 days of the assessor's decision. Or skip the board and go straight to Tax Court within 60 days. The board route costs less and moves faster for most people. The Tax Court is a better fit for complex cases or high-value properties where you need a formal ruling.

Gather evidence before you file. Sales of similar homes in your area help show if your value is too high. Photos of damage or problems with your property matter too. The assessor or board wants facts, not just feelings. A well-prepared appeal has a better chance of getting a reduced value.

Maricopa County Property Tax Exemptions

Maricopa County offers several exemptions that can lower your tax bill. Veterans with a 100% service-connected disability can get a full exemption on their home. This rule went into effect January 1, 2026, and applies to the primary residence only. Other veterans with disability ratings may qualify for partial exemptions as well.

The Senior Freeze Program helps older homeowners on fixed incomes. If you meet the age and income rules, you can lock in your property value for three years. Your taxes stay the same even if home prices in your area go up. Apply through the assessor using ADOR Form 82104. The program renews if you still qualify after three years.

Widows and widowers can also claim an exemption. The same goes for people with total and permanent disabilities. Contact the assessor office at 602-506-3406 to find out if you qualify and what forms you need to file. Exemptions only work if you apply for them. The county does not give them out on its own.

Cities in Maricopa County

Maricopa County is home to many large cities, but none of them collect property taxes directly. All property tax billing runs through the county treasurer. City residents pay city tax rates as part of their county bill. The city portion covers services like fire protection, parks, and debt on voter-approved bonds.

Major cities in Maricopa County with their own pages on this site include:

More Maricopa County cities: Peoria, Surprise, Goodyear, Avondale, Buckeye, and Queen Creek. Each city page shows local tax rates and links to the county resources that serve that area.

Nearby Arizona Counties

Maricopa County sits in the center of Arizona. Several other counties share borders with it. If you own property near the county line, you may need to work with a different assessor and treasurer depending on exactly where the land sits.

Counties next to Maricopa include:

- Pinal County (southeast)

- Yavapai County (north)

- Gila County (east)

- La Paz County (west)

- Yuma County (southwest)

Each county has its own assessor and treasurer with separate websites and contact numbers. Property taxes must be paid to the county where the land is located. If you move across county lines, your tax records will be in the new county starting the next tax year.