Yavapai County Property Tax Records

Yavapai County property tax records are kept by the county assessor and treasurer in Prescott, Arizona. You can search these records to find tax bills, parcel data, and assessed values for any land in Yavapai County. The county sits in central Arizona and covers a vast area from the high desert to pine forests. Whether you own a home in Prescott, land near Sedona, or property in Camp Verde, all your tax records are held at the same county offices. Online tools make it simple to look up your tax bill or check a parcel's value from any device with web access.

Yavapai County Property Tax Facts

Yavapai County Assessor Office

The Yavapai County Assessor sets property values for tax purposes. This office finds all taxable land in the county. Staff then figure out what each piece is worth. They mail Notices of Value to owners each year in February. If you think your value is too high, you have 60 days from the notice date to file an appeal.

You can reach the Yavapai County Assessor at their main office in Prescott. The phone number is 928-771-3220. The office sits at 1015 Fair Street in downtown Prescott. Stop by during normal business hours to look at records in person or ask staff for help with your parcel data. They can show you maps, building records, and sales info for any property in Yavapai County.

The assessor keeps detailed records on every parcel. These files include the legal description, lot size, and building details. You can see the year built, square footage, and type of construction. Sales data from past transactions also goes into the record. All of this helps the assessor set a fair market value for your land. In Arizona, the assessor must set two values. The Full Cash Value shows what your property would sell for today. The Limited Property Value caps how fast your taxes can rise each year.

Search Yavapai County Tax Records Online

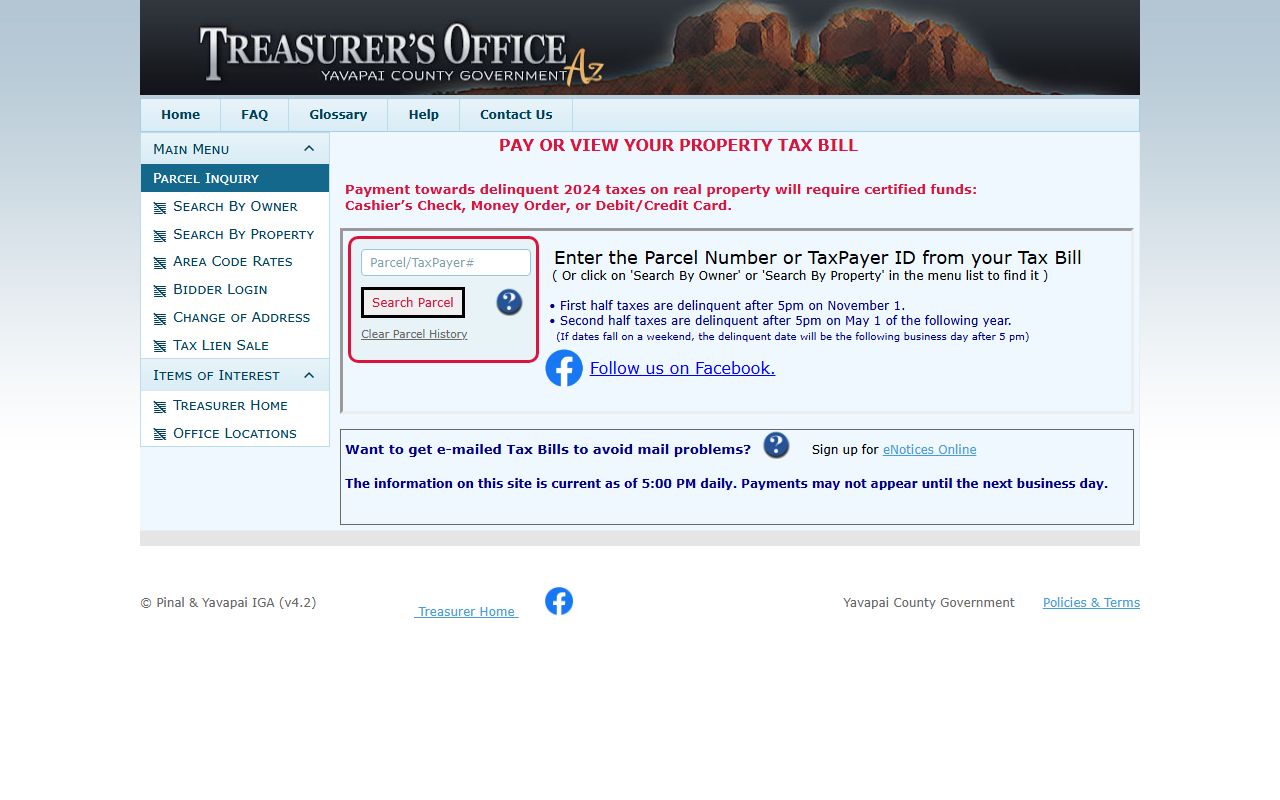

Yavapai County offers a free online tool to search property tax records. The Tax Inquiry portal lets you look up any parcel in the county. You can search by owner name, address, or parcel number. The site shows tax amounts, due dates, and payment status. It works from any computer, phone, or tablet.

The Parcel Search page gives you direct access to property data. Type in what you know and hit search. Results come up fast. Click on a parcel to see the full tax record. You can view the assessed value, tax rate, and amount owed. The site also shows if taxes are paid or past due. This makes it easy to check on any property in Yavapai County without a trip to the courthouse.

Note: The online system is free to use and runs 24 hours a day, so you can look up Yavapai County property tax records any time.

How Yavapai County Property Taxes Work

Property taxes in Yavapai County fund local services. Schools get the biggest share. Fire districts, community colleges, and special districts also get a cut. The county itself uses tax revenue for roads, parks, and public safety. Your tax bill depends on two things: your property value and the tax rates set by each district that covers your land.

The assessor sets your property value each year. Arizona law says the value date is January 1 of the prior year. So taxes you pay in 2026 are based on what your land was worth on January 1, 2025. The assessor looks at sales of similar homes, the cost to build new, and how much rent the property could bring in. For most homes, the sale price of nearby properties matters most.

The Limited Property Value keeps your taxes from jumping too fast. Under state law, this value can only go up 5% per year. Even if home prices spike 20%, your tax base only rises 5%. This helps long-term owners keep their bills in check. But if you buy a new home, the limited value resets to match the full cash value. That means new buyers may see higher taxes than the prior owner paid.

Paying Yavapai County Property Taxes

The Yavapai County Treasurer collects all property taxes. Tax bills go out in September each year. You can pay the full amount by December 31 or split it into two halves. The first half is due October 1. It becomes late after November 1 at 5 p.m. The second half is due March 1 and late after May 1 at 5 p.m.

If you miss a deadline, interest starts right away. The rate is 16% per year. That works out to about 1.33% per month on the amount you owe. On a $3,000 tax bill, you would pay $40 extra for just one month late. The cost adds up fast, so it pays to stay on time. If taxes go unpaid for a full year, the county adds a penalty and puts the property on the delinquent list.

Yavapai County accepts several payment methods. You can pay online through the tax inquiry site. Credit cards, debit cards, and e-checks all work. Each method has a small fee. You can also pay by mail with a check or money order. Or stop by the treasurer office in Prescott to pay in person with cash, check, or card. Pick whichever way is easiest for you.

Note: E-check payments usually have the lowest processing fee, so consider that option if you want to save a few dollars.

Yavapai County Property Tax Appeals

You can challenge your property value if you think the assessor got it wrong. Start by filing a petition with the Yavapai County Assessor. The state provides forms for this. Use ADOR Form 82130 for real property. You must file within 60 days of the date your Notice of Value was mailed. The assessor will review your claim and may agree to lower the value.

If the assessor says no, you have more options. You can take your case to the Yavapai County Board of Equalization. File within 25 days of getting the assessor's decision. The board acts like a small court. They hear both sides and make a ruling. If you still disagree after that, you can appeal to Tax Court. That is the final step in the process. Most people work things out at the assessor or board level, but the court option exists if needed.

Good evidence helps your appeal. Bring recent sales of similar homes that sold for less than your assessed value. Photos of damage or issues with your property can help too. The key is to show why your value should be lower. The board and court both look at facts, not just how you feel about your taxes. Come prepared and you have a better shot at a fair result.

Yavapai County Property Tax Exemptions

Some Yavapai County property owners qualify for tax breaks. Veterans with a 100% service-connected disability can get a full exemption from property taxes on their primary home. Other disabled veterans may get partial relief. Widows, widowers, and people with permanent disabilities also have exemption options. You must apply through the assessor office to claim these benefits.

The Senior Freeze Program helps older residents keep their taxes stable. If you meet the age and income limits, you can lock in your property value for three years. Your value stays flat even if home prices rise. This can be a big help for seniors on fixed incomes who worry about rising tax bills. Contact the Yavapai County Assessor to learn if you qualify and how to apply.

What Yavapai Property Tax Records Show

Yavapai County property tax records contain a lot of useful data. When you look up a parcel, you can find:

- Owner name and mailing address

- Legal description of the property

- Full Cash Value and Limited Property Value

- Tax amounts owed and paid

- Payment history going back several years

- Tax rate breakdown by district

The assessor side of the record also shows building details. You can see square footage, year built, and construction type. Lot size and zoning info appear too. Some records include past sales prices, which helps if you want to compare values across the area. All of this is public information. You do not need to own the property to look it up. Anyone can search Yavapai County tax records for any parcel in the county.

Nearby County Property Tax Records

Yavapai County borders several other Arizona counties. If you own property near the county line or want to compare tax info across the region, check out these neighboring counties. Each has its own assessor and treasurer offices with online search tools.

- Maricopa County to the south (Phoenix area)

- Coconino County to the north (Flagstaff area)

- Mohave County to the west

- La Paz County to the southwest

Property tax rules are the same across Arizona. The state sets the laws and deadlines. But tax rates differ from one county to the next because each area has its own mix of schools, fire districts, and special taxing units. If you are thinking about buying land in the region, compare tax bills across county lines to see how costs stack up.