Mohave County Property Tax Records

Mohave County property tax records are available for public search through the county assessor and treasurer offices in Kingman, Arizona. The county maintains data on 258,932 parcels spread across one of the largest counties in the state by land area. You can look up assessed values, tax bills, and payment history at the county offices or through online search tools. The assessor sets property values each year while the treasurer handles billing and collection. Both offices keep detailed records you can access during business hours or on the web at any time.

Mohave County Property Tax Facts

Mohave County Assessor Property Records

The Mohave County Assessor is Jeanne Kentch. Her office has the job of finding, listing, and setting values on all taxable property in the county. This work follows the rules set out in Arizona Revised Statutes. Each parcel gets a Full Cash Value based on what it would sell for on the open market. The office also sets a Limited Property Value used to figure your actual tax bill. That limited value can only go up 5% per year under state law.

The main assessor office is at 700 W. Beale Street in Kingman, AZ 86402. Call them at (928) 753-0703. Hours are Monday through Friday, 8:00 a.m. to 5:00 p.m. Staff can help you with questions about your property value, classification, or exemptions. They can also show you how to file an appeal if you think your value is too high.

You can visit the Mohave County Assessor website to learn more about services and find forms you might need. The site has links to search tools, appeal information, and contact details for all three office locations in the county.

The assessor sends Notice of Value cards to all property owners in February each year. This card shows your Full Cash Value and Limited Property Value. It also lists your property class. If you disagree with any of these items, you have 60 days from the mailing date to file an appeal with the assessor.

Mohave County Assessor Field Offices

Mohave County covers a large area. To make things easier, the assessor has two field offices in addition to the main office in Kingman. These branch offices offer the same help with property tax records, value questions, and appeal forms. Pick the one that works best for where you live.

The Bullhead City office is at 1130 Hancock Street. The phone number is (928) 758-0701. This office serves the Colorado River area on the west side of the county. Lake Havasu City has an office at 2001 College Drive, Suite 93. Call them at (928) 453-0702. Both field offices keep the same hours as the main office in Kingman. You can get records, ask questions, and submit forms at any of the three locations.

Note: Field office staff may need to contact the main office in Kingman for some requests that require access to central files or systems.

Mohave County Property Tax Treasurer

The Mohave County Treasurer handles the money side of property taxes. This office sends out tax bills, takes payments, and keeps track of who has paid. You can reach the treasurer at (928) 753-0737. The office is at 700 W. Beale Street in Kingman, AZ 86401. That is the same building where the assessor sits.

Tax bills go out each September. They show how much you owe and when you need to pay. You can pay in two halves or all at once. The first half is due October 1 and becomes delinquent after November 1 at 5 p.m. The second half is due March 1 and delinquent after May 1 at 5 p.m. If you want to pay the whole year, do it by December 31 to avoid interest charges. The Mohave County Treasurer website has more details on billing and payment options.

Missing a due date costs you money. Once a tax goes delinquent, the county adds interest at 16% per year. That works out to about 1.33% per month. The rate applies to the amount you owe, not just the late portion. On a $2,000 tax bill, you would owe about $27 more each month the taxes sit unpaid. Pay on time to keep more cash in your pocket.

Search Mohave County Property Tax Records Online

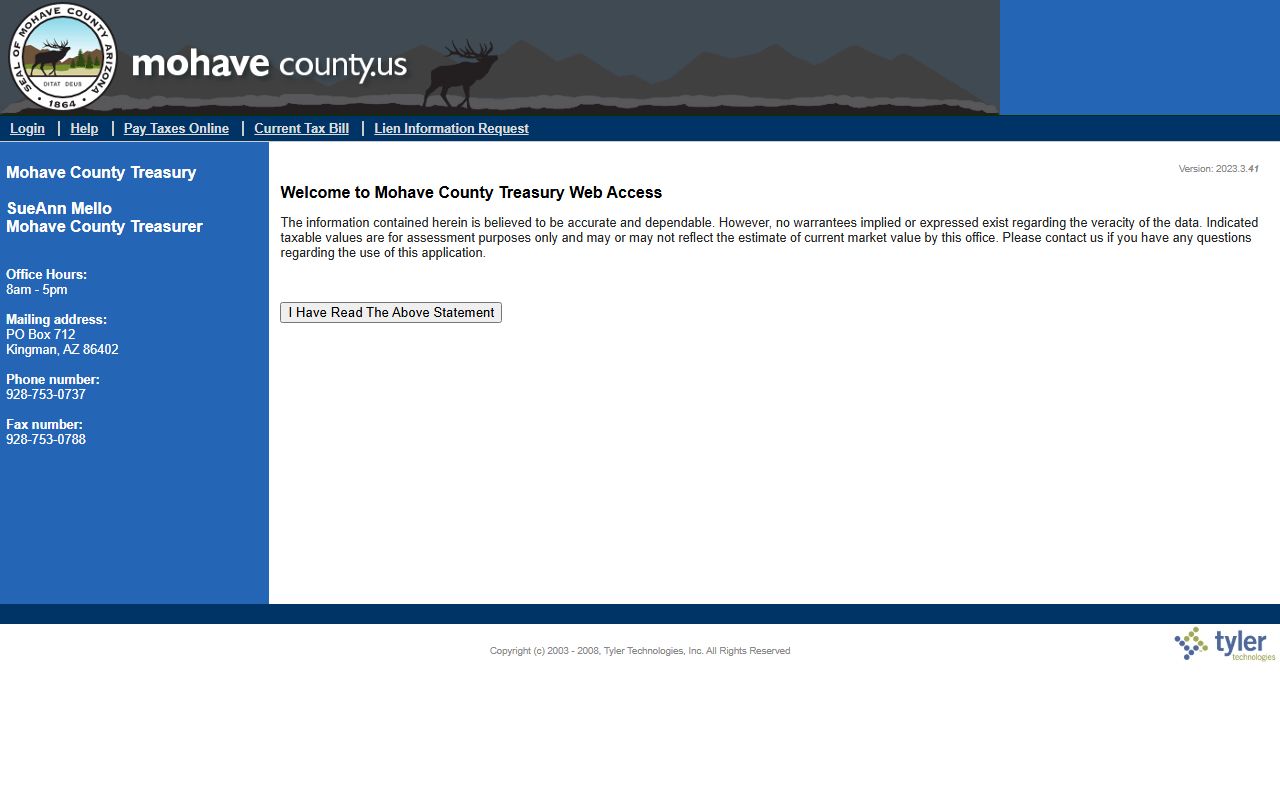

Mohave County gives you free online tools to search property tax records. The Parcel Search system lets you look up any parcel in the county. Enter an address, owner name, or parcel number to find what you need. Results show property details, assessed values, and tax amounts. You can also see payment history and any past due balances.

The system runs on Tyler Technologies EagleWeb platform. This is the same system used by many Arizona counties. Once you find a parcel, you can view the full record with owner name, legal description, land size, and building info. The tax section shows current year and prior year amounts. You can check if taxes are paid, pending, or delinquent. The search tool is free to use and works at any time of day.

Tax data updates when the treasurer posts new payments. Most payments show up within a few business days. Keep in mind that online records are for reference. The official record is what the county has on file at the office. If you spot an error, contact the assessor or treasurer to get it fixed.

Pay Mohave County Property Taxes Online

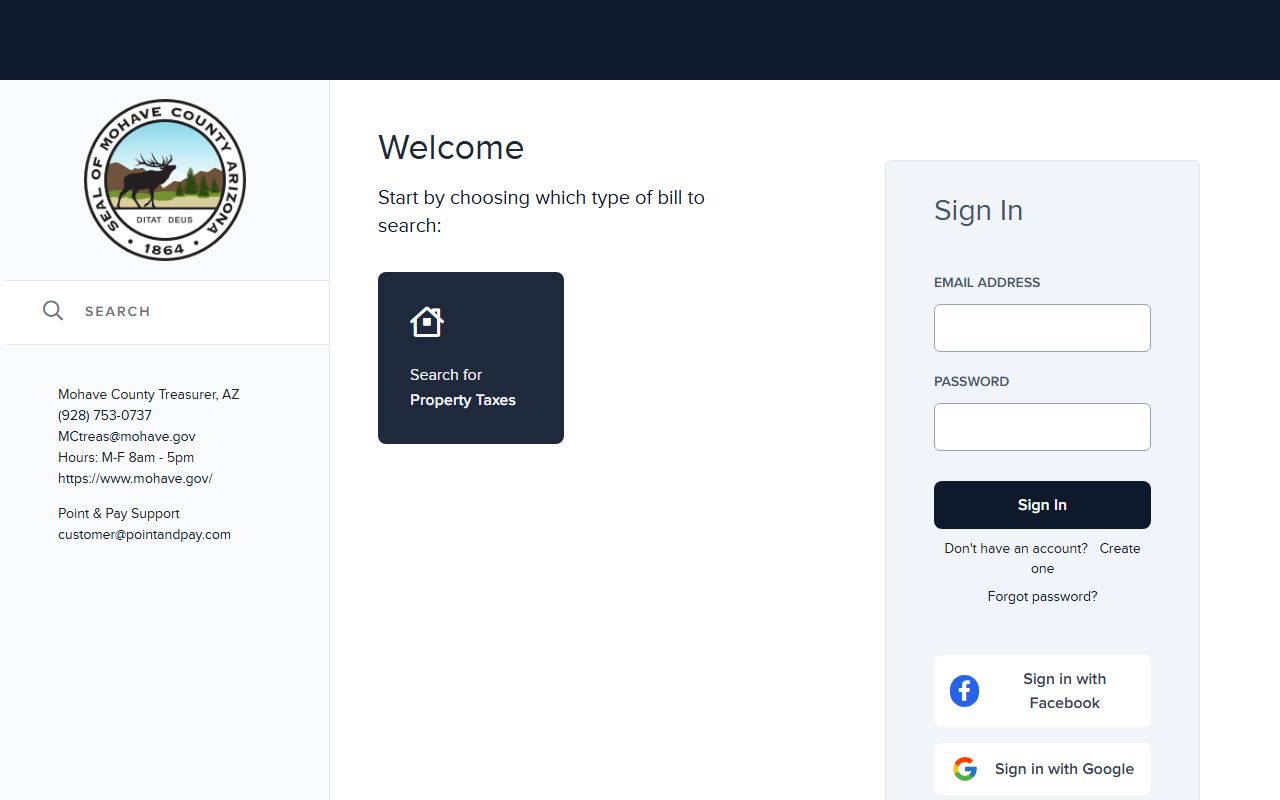

You can pay your Mohave County property taxes online through the Paydici payment portal. Search for your parcel, then follow the steps to pay with a card or bank account. The system accepts credit cards, debit cards, and electronic checks.

Each payment method has a processing fee. Credit cards cost 2.39% of the payment amount with a minimum fee of $1.50. Visa debit cards have a flat $3.50 fee. E-checks are the cheapest option at just $1.00 per transaction. The county does not set these fees. They go to the payment processor to cover costs. Pick the method that makes the most sense for your bill size.

You can also pay in person at the treasurer office in Kingman. Bring cash, check, or a money order. Some people prefer to mail a check. Send it to the address on your tax bill and allow enough time for delivery before the due date. The postmark does not count. Your payment must arrive by the deadline to avoid late charges.

Mohave County Property Tax Appeals

If you think your property value is wrong, you can file an appeal. The process starts with the assessor. Look at your Notice of Value when it arrives in February. Check the Full Cash Value and property class. If something looks off, you have 60 days from the mailing date to act.

File a petition with the Mohave County Assessor using ADOR Form 82130 for real property. Personal property uses Form 82530. You can get these forms at the assessor office or download them from the Arizona DOR forms page. Write down why you think the value is too high. Include any evidence like recent sales of similar homes, an appraisal, or photos showing property condition.

The assessor will review your appeal and make a decision. They may agree and lower your value. If they deny your appeal, you can take it to the next level. File with the County Board of Equalization within 25 days of getting the assessor's decision. The Arizona State Board of Equalization oversees this process. You can also go straight to Tax Court if you prefer, though that costs more and takes longer.

Property Tax Exemptions in Mohave County

Arizona law provides tax relief for certain property owners. Veterans with a 100% service-connected disability rating can get a full exemption on their primary home. Other veterans with disabilities may qualify for partial relief. Widows, widowers, and people with total permanent disabilities have options too. The rules are in ARS 42-11111.

The Senior Freeze program helps older residents keep their taxes stable. It locks in your Limited Property Value for three years if you meet age and income limits. Your value stays the same even if home prices go up around you. Apply through the assessor office using ADOR Form 82104. You must renew every three years to keep the freeze in place.

Contact the Mohave County Assessor office to learn about exemptions you might qualify for. Staff can tell you what forms you need and help you through the process. Deadlines apply, so ask early in the year to make sure you do not miss out.

Mohave County Tax Liens and Delinquent Taxes

Unpaid property taxes create problems. Once you miss a deadline, interest starts at 16% per year. If taxes stay unpaid through January of the next year, the county adds a $5 or 5% penalty, whichever is more. They also publish your name and property in the local paper. A lien goes on record against your land.

Under Arizona law, a tax lien takes first place ahead of most other claims. That means if you try to sell or refinance, the back taxes must be paid first. The county holds tax lien sales each February. Investors can buy the liens and earn interest on the unpaid amount. If the property owner does not pay within a set time, the lien holder may be able to take the property.

Check your tax status often. Use the online search tools to see if any balances are due. If you have trouble paying, contact the treasurer early. They may be able to set up a payment plan before things get worse. Catching a problem early saves money and stress.

Note: The county sends delinquency notices by mail, but some get lost. Do not rely on getting a notice to know you owe back taxes.

Mohave County Cities and Nearby Areas

Property taxes in Arizona are handled at the county level. Cities set their own tax rates but do not collect taxes directly. If you live in a city within Mohave County, you still pay your property taxes to the county treasurer. The city rate just gets added to your bill along with school and special district rates.

Lake Havasu City is the largest city in Mohave County with property tax records handled through these county offices. The city has its own tax rate of $0.6718 per $100 of assessed value. That amount is part of your total bill, but the county still sends it out and collects the payment. Lake Havasu City residents can use the assessor field office at 2001 College Drive for in-person help.

Mohave County shares borders with three other Arizona counties. To the south sits La Paz County, which was created from the southern portion of Mohave County in 1983. To the east you find Yavapai County and Coconino County. If you own land near a county line, make sure you know which county your parcel falls in. The assessor can confirm this for you.

Mohave County Property Tax Contacts

Here is a quick list of the main contacts for property tax questions in Mohave County. Keep these numbers handy when you need help with records, bills, or payments.

- Assessor Main Office: (928) 753-0703, 700 W. Beale Street, Kingman AZ 86402

- Assessor Bullhead City: (928) 758-0701, 1130 Hancock Street

- Assessor Lake Havasu City: (928) 453-0702, 2001 College Drive Suite 93

- Treasurer: (928) 753-0737, 700 W. Beale Street, Kingman AZ 86401

Both the assessor and treasurer offices in Kingman are open Monday through Friday from 8 a.m. to 5 p.m. Field offices keep the same schedule. The online search and payment tools work around the clock if you need access outside normal hours. For state-level questions about Arizona property tax rules, contact the Arizona Department of Revenue Property Tax Unit at (602) 716-6843.