Buckeye Property Tax Records

Buckeye property tax records are kept by Maricopa County, not by the city itself. The county assessor sets values on land and buildings while the treasurer sends out bills and takes payments. Buckeye is one of the fastest growing cities in Arizona with over 114,000 residents. You can search tax records for any Buckeye address online through the Maricopa County website. The search is free. It shows assessed values, tax amounts, and payment history. Most people find what they need in just a few minutes without ever calling an office or making a trip downtown.

Buckeye Property Tax Quick Facts

How Buckeye Property Tax Works

Cities in Arizona do not collect property taxes on their own. All billing goes through the county. For Buckeye, that means Maricopa County handles everything from setting values to taking payments. The city does set its own tax rate, though. Your bill includes a portion that goes to Buckeye for city services like fire protection and parks.

Buckeye has a primary property tax rate of $1.60 per $100 of assessed value. The city caps its total tax rate at $2.25, which is the highest it can go under current law. Primary taxes pay for basic city operations. Secondary taxes fund voter-approved bonds and special projects. Most homeowners pay both on their bill. The exact amount depends on your property value and what tax districts cover your address.

Your tax bill also includes levies from Maricopa County, the state, local school districts, and any special districts in your area. Each one adds to the total. Buckeye residents often see school taxes take the biggest slice of their payment. The county treasurer combines all these amounts into one bill that you pay twice a year or all at once.

Maricopa County Offices for Buckeye Tax Records

The Maricopa County Assessor keeps records on every Buckeye parcel. This office values your land and buildings each year. They mail a Notice of Value to let you know what they think your property is worth. Two numbers matter most on that notice. Full Cash Value shows the market price. Limited Property Value is what they use to figure your tax bill.

The Maricopa County Treasurer handles billing and payment. Tax bills go out each September. You can pay the first half by October 1 or the full year by December 31. The second half is due March 1. Miss a deadline and interest starts at 16% per year. That adds up fast on any size bill.

Both offices are in Phoenix at 301 W Jefferson Street. The drive from Buckeye takes about 30 to 40 minutes depending on traffic. But you rarely need to go in person. Most tasks can be done online or by phone. The assessor number is 602-506-3406. The treasurer can be reached at 602-506-8511. Office hours are Monday through Friday from 8 a.m. to 5 p.m.

Note: Online records are updated regularly but may lag a few days behind payments or value changes.

Search Buckeye Property Tax Records Online

You can look up any Buckeye property on the Maricopa County website. The assessor has a parcel search tool. Type in an address or owner name and it pulls up the record. You can see lot size, building details, sale history, and assessed values. The tool is free and works any time of day.

The Maricopa County GIS parcel viewer shows maps of every lot in Buckeye. Zoom in on your area to see property lines. Click on any parcel to get basic info. The map helps when you only know the general location of a property. Real estate agents and title companies use it daily. Homeowners find it handy for checking lot dimensions before a fence project or room addition.

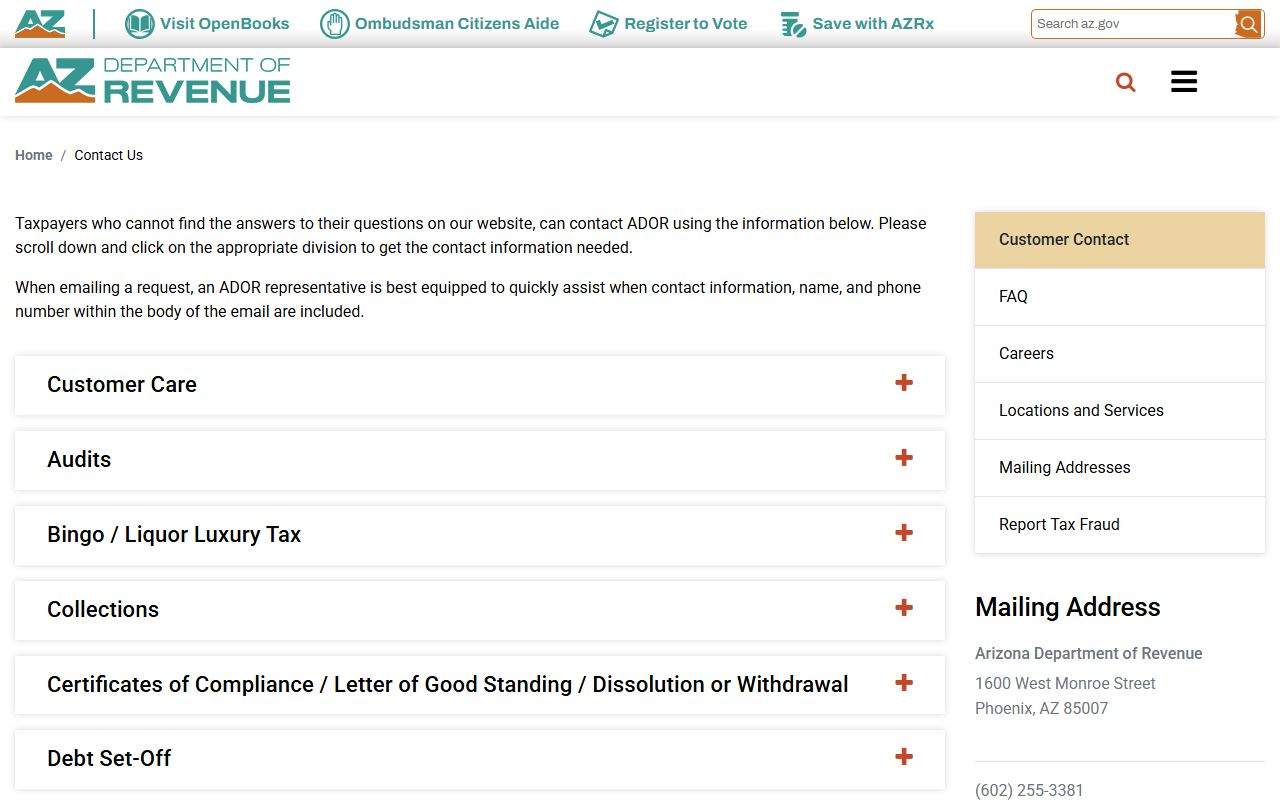

The Arizona Department of Revenue provides state-level guidance on property tax rules that apply in Buckeye and across Arizona.

The state office answers policy questions but does not have records for specific parcels. Contact Maricopa County for any Buckeye address lookups. The county sites let you search by parcel number too if you already know it from a prior bill or title document.

Paying Buckeye Property Taxes

All Buckeye property tax payments go to the Maricopa County Treasurer. You have several ways to pay. E-check has no fee, which makes it the cheapest option. Debit cards cost 1.80% of the amount. Credit cards run 2.25%, and that includes Visa, MasterCard, Discover, and American Express. Digital wallets like PayPal and Venmo also work but charge 2.25%.

You can pay online at the treasurer website. Mail payments go to PO Box 52133, Phoenix AZ 85072-2133. If you want to pay in person, visit 301 W Jefferson St, Suite 100, in Phoenix. There is no Maricopa County treasurer office in Buckeye itself, so online or mail payment saves you a trip.

Key payment dates for Buckeye property owners:

- October 1: First half due

- November 1 at 5 p.m.: First half delinquent

- December 31: Full year payment deadline

- March 1: Second half due

- May 1 at 5 p.m.: Second half delinquent

Late payments carry 16% annual interest. That works out to about $1.33 per month for every $100 you owe. The county does not send reminder notices before deadlines. Mark them on your calendar or set up auto-pay through the treasurer site to avoid extra charges.

Buckeye Property Tax Appeals

Think your property value is too high? You can file an appeal. Start with the Maricopa County Assessor. You have 60 days from when the Notice of Value was mailed. Use ADOR Form 82130 for your home or Form 82530 for business property. The assessor reviews your claim and may agree to lower the value.

If the assessor says no, you have more options. File with the County Board of Equalization within 25 days of the assessor's decision. Or go straight to Tax Court within 60 days. Most Buckeye homeowners start with the board since it costs less and moves faster. The Tax Court makes sense for high-value properties or complex cases where you need a formal ruling.

Gather evidence before you file. Sales of similar homes in Buckeye help show if your value is off. Photos of any damage or problems with your property matter too. The assessor and board want facts. A well-prepared appeal has a better shot at getting a reduced value. Keep copies of everything you submit.

Buckeye Property Tax Exemptions

Several exemptions can lower your Buckeye property tax bill. Veterans with a 100% service-connected disability can get a full exemption on their home. This rule went into effect January 1, 2026. Other veterans with disability ratings may qualify for partial exemptions too.

The Senior Freeze Program helps older homeowners on fixed incomes. If you meet the age and income rules, you can lock in your property value for three years. Your taxes stay the same even if home prices in Buckeye keep rising. Apply through the assessor using ADOR Form 82104. The program renews if you still qualify after three years.

Widows, widowers, and people with total permanent disabilities can also claim exemptions. Contact the Maricopa County Assessor at 602-506-3406 to find out if you qualify. Exemptions only work if you apply for them. The county does not give them out on its own. You must file the forms and provide any proof they ask for.

Note: Most exemptions apply only to your primary residence in Buckeye, not rental or investment properties.

Nearby Cities in Maricopa County

Buckeye sits in the western part of Maricopa County. Several other cities are close by. All of them use the same county assessor and treasurer for property tax matters. If you own land near a city border, check which address the county has on file to make sure you search the right parcel.

Cities near Buckeye with pages on this site include:

Each city sets its own tax rate, but Maricopa County handles all the billing. Your tax bill shows exactly how much goes to your city versus the county, schools, and special districts. If you move from Buckeye to another Maricopa County city, your new property will show up in the same county system with a different city rate on the bill.

Buckeye Tax Rates and Growth

Buckeye has grown fast over the past decade. More homes mean more parcels on the tax rolls. The city uses property tax revenue to fund fire stations, parks, roads, and other services that new residents need. The primary tax rate of $1.60 helps pay for day-to-day operations.

The total tax rate cap of $2.25 gives Buckeye room to issue bonds for big projects if voters approve. Secondary taxes cover debt payments on those bonds. Not all Buckeye addresses have the same total rate. It depends on which school district and special districts overlap your parcel. The county treasurer bill breaks down each piece so you can see exactly where your money goes.

Under ARS 42-13301, your Limited Property Value can only go up 5% per year. This rule helps keep tax bills from jumping too fast when home prices rise. Many Buckeye homeowners benefit from this cap as the city grows and property values climb. The full cash value on your Notice of Value may show a higher number, but the limited value is what counts for your tax bill.