Avondale Property Tax Records

Avondale property tax records are managed by Maricopa County, not the city itself. You can search these records online through county assessor and treasurer websites. The assessor tracks property values for all parcels in Avondale. The treasurer sends out bills and takes payments. With a population near 90,500, Avondale is one of the larger cities in the West Valley area of metro Phoenix. Finding your tax records takes just a few minutes using county search tools. You can look up any parcel by address, owner name, or parcel number to see values, bills, and payment status.

Avondale Property Tax Quick Facts

How Avondale Property Taxes Work

The City of Avondale does not collect property taxes on its own. All tax billing and collection runs through Maricopa County offices. This is true for every city in Arizona. The county assessor sets values. The county treasurer sends bills. Your payment goes to the county, and then gets split among all the taxing districts that serve your area.

Your Avondale tax bill includes many parts. School districts take the biggest share by far. The city portion makes up about 11% of what you pay. Fire districts, community colleges, and special improvement areas also get a slice. When you pay your bill, the county divides the money based on set rates for each district. You write one check, but it funds many local services.

Primary taxes on a $100,000 home in Avondale run about $60.95. Secondary taxes add more depending on bond issues and overrides passed by voters. The exact amount you owe depends on where your home sits and what districts cover it. Two homes in Avondale might have different rates if they fall in different school zones or fire districts.

Avondale Property Tax Assessor Records

The Maricopa County Assessor keeps track of every taxable parcel in Avondale. This office puts a value on land and buildings each year. You get a Notice of Value in the mail around February that shows two key figures. The Full Cash Value is what your home would sell for on the open market. The Limited Property Value is what the county uses to figure out your tax bill.

Arizona law caps how fast the limited value can grow. It can go up at most 5% per year under normal rules. This keeps your tax bill from jumping too fast even when home prices soar. The cap does not apply if you make major changes to the property or if the land sells to a new owner. New owners start fresh based on the current market value.

Assessor records show more than just values. You can find lot size, square footage, year built, and construction type. The record also lists the property class. Homes fall under Class 3, which has a 10% assessment ratio. That means only 10% of the limited value gets taxed. A home with a limited value of $300,000 has an assessed value of $30,000. Tax rates apply to that assessed value, not the full amount.

Note: Contact the assessor at 602-506-3406 if you have questions about how your Avondale property was valued.

Arizona Property Tax Resources for Avondale

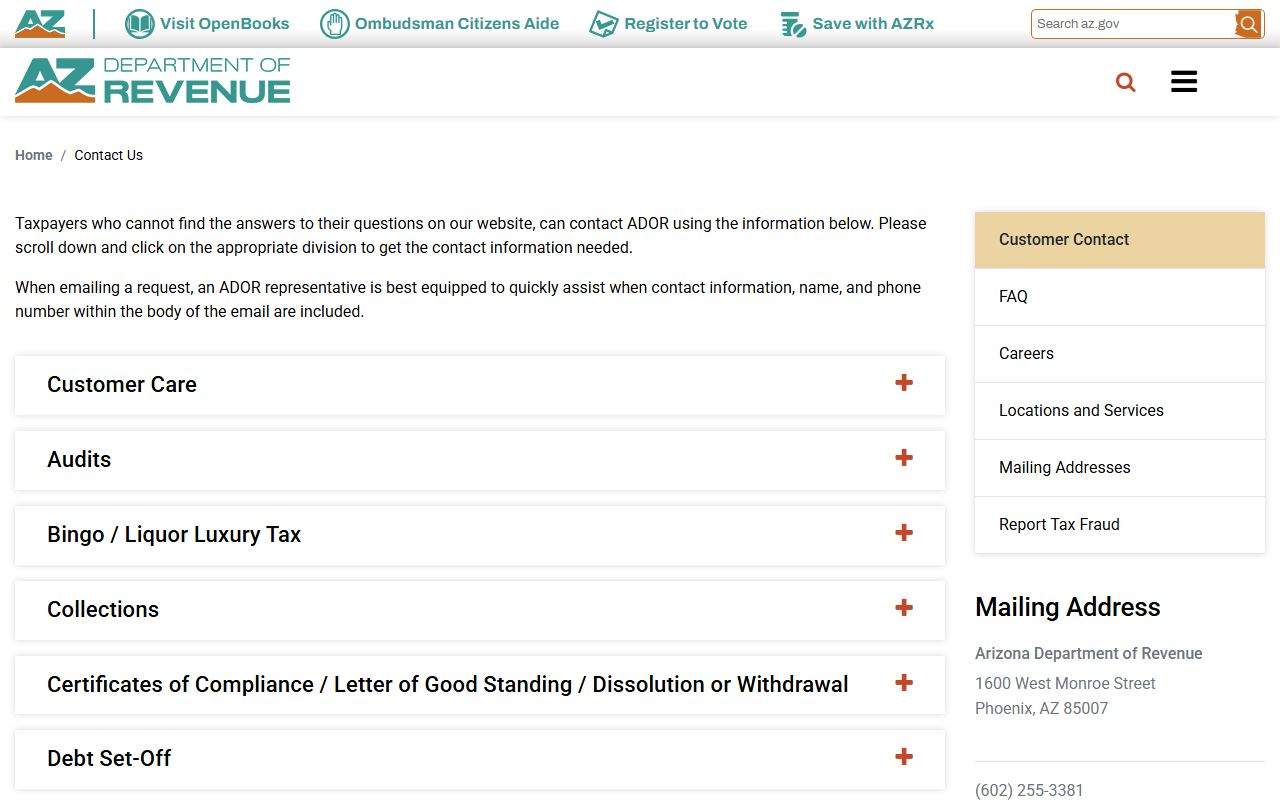

The Arizona Department of Revenue sets the rules that apply to all property taxes in the state, including those for Avondale parcels. This office does not handle individual tax records. But it does publish guides, forms, and FAQs that explain how the system works. You can reach the Property Tax Unit at 602-716-6843 with policy questions.

The ADOR site has forms for exemptions, appeals, and business property filings. Avondale property owners use these same state forms when they need to challenge a value or claim a tax break. Most forms can be downloaded as PDFs. Fill them out and send to either the state or county office depending on the form type. The site also lists current exemption amounts and explains who can qualify for them.

Avondale Property Tax Treasurer Records

The Maricopa County Treasurer handles all billing for Avondale properties. Tax statements go out each September. Your bill shows exactly what you owe, lists every taxing district, and tells you when payment is due. The treasurer website lets you look up your bill by address or parcel number at any time.

You can pay Avondale property taxes in two parts or all at once. The first half is due October 1. It turns delinquent if not paid by 5 p.m. on November 1. The second half is due March 1 and goes delinquent after May 1. If you want to pay the full year at once, get it in by December 31 to avoid interest. The county charges 16% annual interest on late payments. That adds up fast.

Payment methods give you options. E-check costs nothing extra. Debit cards run 1.80% of the payment. Credit cards and digital wallets like PayPal or Apple Pay cost 2.25%. Most people use e-check to avoid fees. You can also mail a check or pay in person at the treasurer office in downtown Phoenix. The mailing address is PO Box 52133, Phoenix AZ 85072-2133.

Search Avondale Property Tax Records Online

Maricopa County offers free online tools to search property tax records for Avondale homes and land. The assessor site lets you pull up any parcel to see values, ownership, and property details. The treasurer site shows tax bills and payment history. Both sites work from any computer or phone with web access.

To find your Avondale property records:

- Go to the assessor or treasurer website

- Enter your address, owner name, or parcel number

- Review the results that match your search

- Click on your parcel to see full details

- Print or save records you need for your files

The Maricopa County GIS Parcel Viewer adds another search option. This map tool shows all parcel lines in the county. Zoom in on your Avondale neighborhood to see lot shapes and parcel numbers. Click any parcel to get basic info. This helps when you know where a property is but do not have the exact address.

These tools are public and free. You do not need an account to search. The records cover current values and bills plus history going back several years. Real estate agents, title companies, and appraisers use these same tools every day to research Avondale properties.

Avondale Property Tax Appeals

You can challenge your property value if you think it is set too high. The appeal process starts with the Maricopa County Assessor. File within 60 days of the date on your Notice of Value. Use Form 82130 for real property. Write down why you think the value is wrong and include any evidence you have.

Good evidence makes a difference. Sales of similar homes in Avondale help show what your property should be worth. Photos of damage or problems count too. An old roof, cracked foundation, or other issues can lower value. The assessor wants facts, not feelings. Pull together your case before you file.

If the assessor says no, you have more options. File with the County Board of Equalization within 25 days. This board acts like a court and can change your value. You can also go straight to Tax Court within 60 days if you prefer a formal legal ruling. Most Avondale homeowners start with the board since it costs less and moves faster. The State Board of Equalization oversees the county boards and posts guides on how to prepare your case.

Avondale Property Tax Exemptions

Several exemptions can lower your Avondale property tax bill if you qualify. Veterans with a 100% service-connected disability now get a full exemption on their primary home. This change took effect January 1, 2026. Other veterans with disability ratings may qualify for partial breaks as well. Apply through the assessor office.

The Senior Freeze Program helps older Avondale homeowners. If you meet age and income rules, you can lock in your property value for three years. Your taxes stay flat even if home values climb. This gives peace of mind to seniors on fixed incomes worried about rising tax bills. Use Form 82104 to apply.

Widows, widowers, and people with total permanent disabilities have exemption options too. Each program has its own rules on who qualifies and how much you save. Contact the Maricopa County Assessor at 602-506-3406 to learn which exemptions might apply to your situation. You must file an application to get any exemption. The county does not give them out on its own.

Avondale Property Tax Payment Deadlines

Mark these dates on your calendar to avoid late fees on your Avondale property taxes. The county sends bills in September. From there, a strict schedule applies.

- October 1: First half payment due

- November 1 at 5 p.m.: First half becomes delinquent

- December 31: Last day to pay full year without interest

- March 1: Second half payment due

- May 1 at 5 p.m.: Second half becomes delinquent

Late payments hurt your wallet. Interest runs 16% per year, which works out to about 1.33% per month. On a $3,000 tax bill, you would pay an extra $40 for just one month late. If taxes stay unpaid through the next year, the county adds more penalties and puts your property on a list for tax lien sale. The February auction lets investors buy the liens. Getting your property back after that costs even more.

Note: The treasurer does not send reminders before deadlines, so set up your own alerts to stay on time.

Nearby West Valley Cities

Avondale sits in the West Valley area of metro Phoenix. Several other cities are nearby, and all use the same Maricopa County offices for property tax records. If you own property in multiple cities, your search process stays the same. Just look up each parcel by its address or number on the county sites.

Other West Valley cities with pages on this site include Phoenix, Goodyear, Glendale, and Buckeye. Each page shows local details and links to the county resources that serve that area. Tax rates vary by city based on bonds, overrides, and local district needs. The county assessor and treasurer handle records for all of them.

Maricopa County serves the entire region. The assessor office is at 301 W Jefferson Street in Phoenix. The treasurer is in the same building. Both offices are open Monday through Friday from 8 a.m. to 5 p.m. You can call the assessor at 602-506-3406 or the treasurer at 602-506-8511 with questions about Avondale property tax records.