Yuma County Property Tax Records

Yuma County property tax records are held by the county assessor and treasurer in downtown Yuma. You can search these public records online to find assessed values, tax bills, and payment status for any parcel in the county. The assessor sets property values while the treasurer handles tax collection. Both offices serve the entire county from their Main Street location. Most records are free to view through the county website. You can look up any property by owner name, address, or parcel number to see its full tax history and current amounts due.

Yuma County Property Tax Quick Facts

Yuma County Property Tax Assessor

The Yuma County Assessor handles all property values in the county. Steven Seale serves as the current assessor. His office works to find, list, and set values on all land and buildings that owe taxes. Every year the assessor mails a Notice of Value to each property owner. This card shows your Full Cash Value and Limited Property Value.

The assessor office is at 197 S. Main Street in Yuma, AZ 85364. You can call them at (928) 373-6040 with questions. Email works too. Send messages to assr-info@yumacountyaz.gov for help with your account. Staff can explain how they set your value. They can tell you about sales data used in the process. The office keeps records on every parcel in the county. This includes lot size, building type, year built, and more.

When you get your Notice of Value, check it right away. The value on that card is what your tax bill will be based on. If it seems too high, you have 60 days to file an appeal. Start by talking to the assessor staff. They may be able to fix errors on the spot. Under ARS 42-16051, you can file a formal petition if you still disagree after talking to them.

Yuma County Property Tax Treasurer

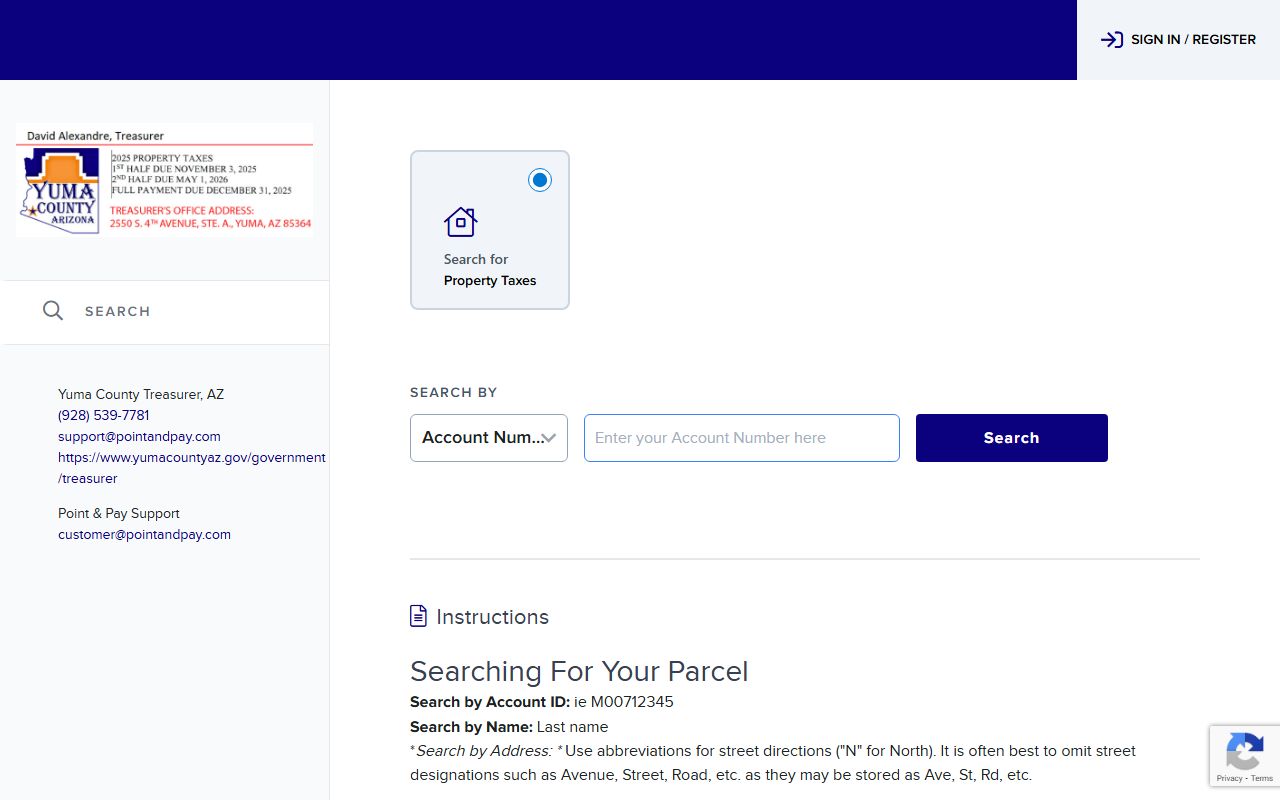

David Alexandre is the Yuma County Treasurer. His office sends out tax bills and takes payments. You can reach the treasurer at 928-539-7781. For email, use treasury@yumacountyaz.gov. The staff can help with questions about your bill or payment options.

Property tax bills in Yuma County go out each September. You have two ways to pay. The first half is due October 1 and late after November 1 at 5 p.m. The second half is due March 1 and late after May 1. Or you can pay the full year by December 31 to avoid any interest charges. Once a payment is late, interest starts at 16% per year. That adds up fast. A $3,000 tax bill would add $40 in interest the first month alone.

The treasurer keeps records of all payments made on each parcel. You can look up payment history for any property in the county. This is useful if you just bought a home and want to see past tax amounts. It also helps when checking if back taxes are owed before a purchase.

Note: The treasurer office does not set property values. Contact the assessor if you have questions about your assessed value.

Search Yuma County Tax Records Online

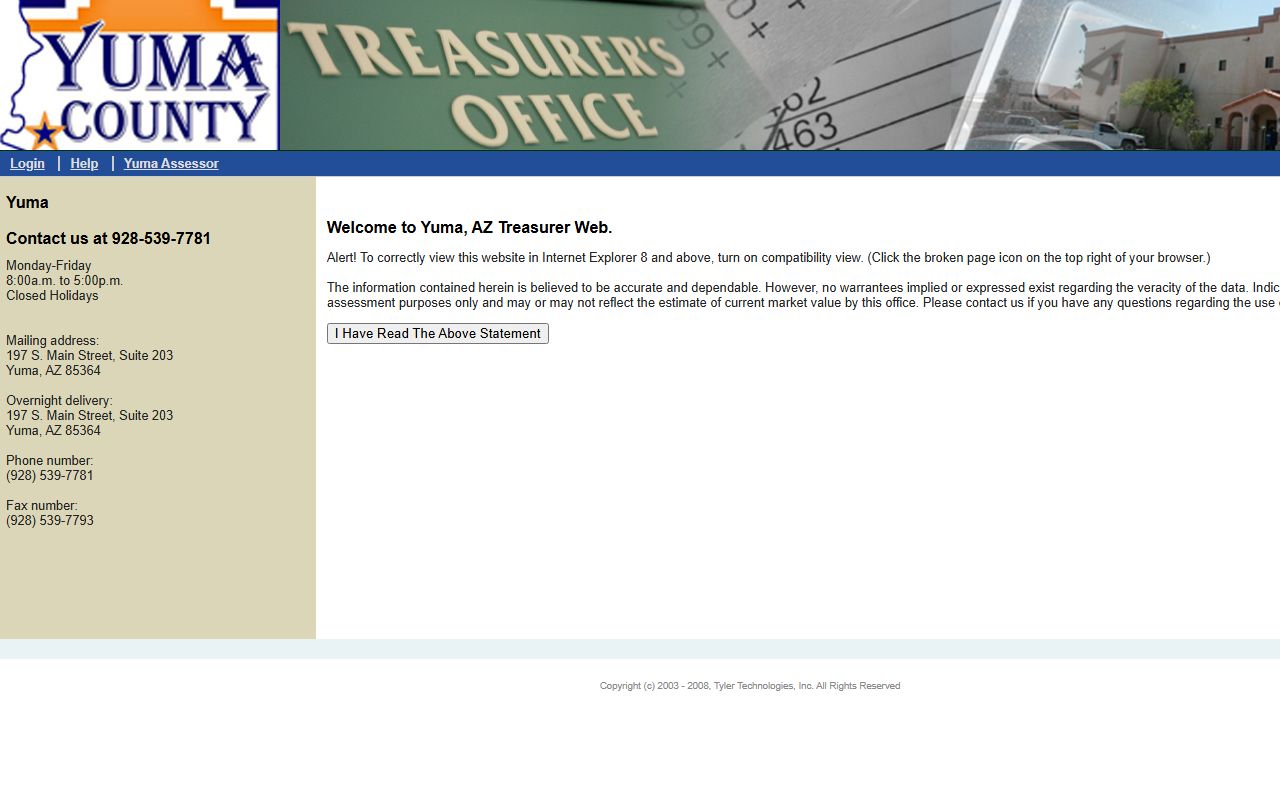

Yuma County offers online tools to search property tax records from home. The county uses the EagleWeb system from Tyler Technologies. This portal lets you look up any parcel by owner name, address, or parcel number. Results show the full property record including values, legal description, and tax amounts.

You can access the Yuma County Treasurer EagleWeb portal to view tax bills and payment status for any parcel in the county. The site is free to use. No login is needed for basic searches. You can see current and past tax bills, check if payments are up to date, and view the breakdown of where your tax dollars go.

The search tool shows detailed tax information. Each result lists the parcel number, owner name, property address, and legal description. You can see the assessed values used to figure the tax amount. The site also shows any liens or past due amounts on the property. This makes it easy to research tax records before buying land or a home in Yuma County.

Yuma County Property Tax Payment Options

Yuma County gives you several ways to pay your property taxes. Pick the method that works best for you.

Online payment is quick and easy. Go to the Yuma County online payment portal to pay by card or e-check. The site walks you through the steps. Enter your parcel number to find your account. Then choose how much to pay and enter your payment details. Fees may apply based on your payment method. E-check usually costs less than credit cards.

Phone payments work well if you prefer talking to someone. Call 1-877-690-3729 and use Jurisdiction Code 1311 to reach the Yuma County payment line. Have your parcel number and payment info ready. The automated system takes cards and can process your payment in minutes. This option is great for those who want to pay quickly but do not use computers much.

You can also pay in person or by mail. Visit the treasurer office at their Main Street location in Yuma. Bring your tax bill stub and payment. Cash, check, and cards are accepted at the counter. To pay by mail, send a check to the address on your tax bill. Include the payment stub so they can credit the right account. Mail payments should be sent early to arrive before the due date.

Property Tax Appeals in Yuma County

Think your Yuma County property is worth less than the assessed value? You can appeal. The process starts with the county assessor. File your appeal within 60 days of when the Notice of Value was mailed. Use ADOR Form 82130 for real property. The form asks you to explain why you think the value is wrong. Include any proof you have like recent sales data or photos of property problems.

The assessor will review your claim. They may agree and lower the value. If they do, the case is closed. If you still disagree after the assessor decision, you have more options. Within 25 days you can appeal to the County Board of Equalization. The Arizona State Board of Equalization oversees this process. You can also skip the board and go to Tax Court within 60 days. Most people try the board first since it costs less and moves faster than court.

Keep good records when you appeal. Photos, repair bills, and sale prices from nearby homes all help your case. The board acts like a judge. They look at the facts both sides present. Their goal is to set a fair value on your property. Be ready to explain your position clearly at the hearing.

Yuma County Property Tax Values

Arizona uses two values for property tax purposes. The Full Cash Value shows what the property would sell for. The Limited Property Value is used to figure your actual tax bill. Under state law, the limited value can only go up 5% per year. This helps protect owners from big tax jumps when home prices rise fast.

The assessment ratio matters too. Homes use a 10% ratio in Arizona. That means if your limited value is $200,000, the assessed value is $20,000. Tax rates are then applied per $100 of assessed value. So a rate of $10 per $100 on that home would mean a $2,000 tax bill. Different tax districts overlap in Yuma County. Schools, fire districts, and other local bodies each add their own rate. Your total bill depends on where the property sits.

Yuma County property owners should check both values on their Notice of Value each year. The full cash value affects what happens if you sell. The limited value affects your tax bill. Both can be appealed if you think they are wrong. Just act fast because you only have 60 days from the mailing date to start an appeal.

Note: Tax rates change each year based on local budgets. Check your bill for the current rates that apply to your parcel.

Yuma County Property Tax Exemptions

Some Yuma County residents may qualify for property tax breaks. Veterans with a 100% service-connected disability can get a full exemption on their home. This big change took effect January 1, 2026. Other veterans with disability ratings may qualify for partial exemptions under ARS 42-11111. Widows, widowers, and people with total permanent disabilities also have exemption options.

The Senior Freeze Program helps older residents. If you meet the age and income rules, you can lock in your property value for three years. Your taxes stay steady even if home prices in your area go up. Contact the Yuma County Assessor to apply. Use ADOR Form 82104 for this program. Staff can explain the income limits and other requirements.

Cities in Yuma County

Yuma County includes several cities and towns. The largest is the City of Yuma with over 100,000 residents. Property taxes for all these areas are handled at the county level. The city sets tax rates but does not collect taxes directly. All billing and payment goes through the county treasurer.

Residents in any part of Yuma County use the same assessor and treasurer offices. Whether you live in downtown Yuma, San Luis, Somerton, or the unincorporated areas, your property tax records are at the county offices on Main Street. Online tools also work for all parcels county-wide.

Nearby Arizona Counties

Yuma County sits in the southwest corner of Arizona. It borders California to the west and Mexico to the south. Several other Arizona counties are nearby. If you own property in more than one area, you will need to work with each county separately for tax records.

Yuma County Property Tax Office Contacts

Here is how to reach the Yuma County property tax offices directly.

Yuma County Assessor

Steven Seale, Assessor

197 S. Main Street

Yuma, AZ 85364

Phone: (928) 373-6040

Email: assr-info@yumacountyaz.gov

Website: www.yumacountyaz.gov/government/assessor

Yuma County Treasurer

David Alexandre, Treasurer

Phone: 928-539-7781

Email: treasury@yumacountyaz.gov

Website: www.yumacountyaz.gov/government/treasurer

Both offices are in downtown Yuma. Call ahead if you plan to visit. Staff can answer most questions by phone or email. For complex issues, an in-person meeting may work better. Bring your parcel number and tax bill when you go.