Yuma Property Tax Lookup

Yuma property tax records are kept by Yuma County, not the city. The county assessor sets property values each year. The county treasurer sends out bills and takes payments. You can look up Yuma tax records online through the county website at no cost. Enter an address or parcel number to see assessed values, tax amounts owed, and payment history. The city sets its own tax rates but does not collect taxes on its own. All billing and collection runs through the county offices on Main Street in downtown Yuma. Finding your tax record takes just a few clicks on the county portal.

Yuma Property Tax Quick Facts

Yuma Tax Records Through the County

The City of Yuma does not collect property taxes. All Yuma property tax records are held by Yuma County. The county assessor finds and values every parcel in the city. The county treasurer sends the tax bill and takes your payment. This is how all Arizona cities work. No city in the state runs its own property tax system.

When you pay your Yuma property tax, the money gets split up. Part goes to the city. Part goes to the school district. Part goes to the county and state. Special districts like fire protection and flood control also get shares. Your tax bill lists every district and shows how much each one gets. The city portion pays for services like parks, streets, and debt on bonds that voters approved. Yuma residents can reach city hall at (928) 373-5000 for general questions, but tax records go through the county.

Yuma sets two tax rates each year. The primary rate funds general city operations. The secondary rate pays off bonds and other voter-approved debt. These rates apply only to the city portion of your bill. The full tax bill includes rates from all districts that serve your property. School districts often make up the largest chunk of the total bill.

Arizona Property Tax Overview

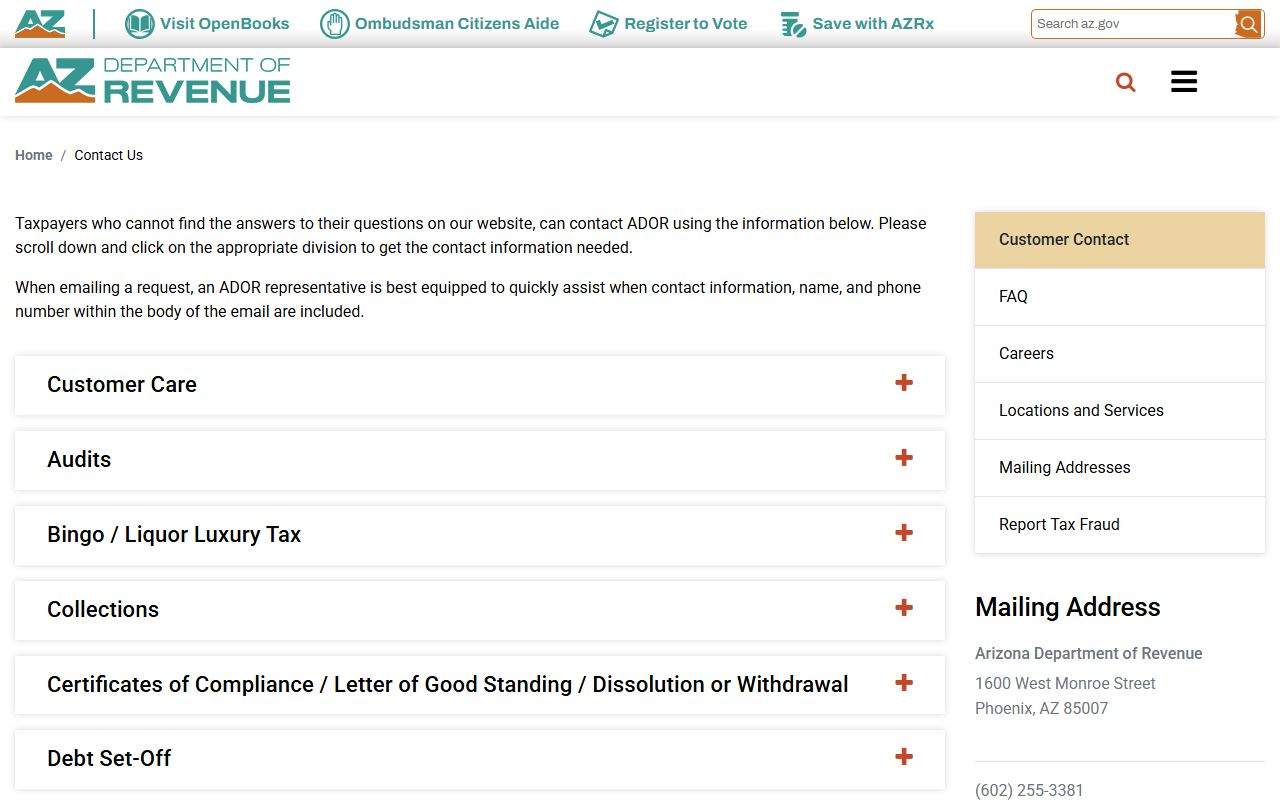

The Arizona Department of Revenue oversees property tax rules across the state. Their website explains how the tax system works. It covers assessment ratios, tax rates, and exemption programs that apply to all Arizona cities including Yuma. The department also sets forms used for appeals and exemption requests.

The ADOR property tax page provides guidance on Arizona tax procedures.

ADOR does not collect local taxes. That job stays with each county. But the department makes rules that counties must follow. They set the forms used for valuation notices and appeals. They also run the State Board of Equalization, which hears appeals when taxpayers and county assessors cannot agree on property values.

How to Search Yuma Tax Records

Start at the Yuma County Treasurer website. The EagleWeb portal lets you look up any property in Yuma. Type in the street address or the owner name. The results page shows assessed values, tax amounts due, and payment status. You can also search by parcel number if you have it. The site is free and does not need a login for basic searches.

For questions about how your value was set, use the Yuma County Assessor site. Their records show lot size, building details, and the data used to figure your value. Both offices serve the same parcels. The assessor sets the value. The treasurer sends the bill and collects the payment. Knowing which office to call saves you time.

The county also runs a GIS map viewer. It shows parcel lines on a map of the whole county. Zoom into Yuma to find any property. Click on a parcel to see its basic info. This tool helps when you know where a property sits but not the exact address. It also shows neighboring parcels so you can compare values in your area.

Yuma County Assessor for Yuma City

The Yuma County Assessor values all Yuma property each year. Steven Seale serves as the current assessor. His office mails a Notice of Value in February. This notice shows the Full Cash Value and Limited Property Value for your land and buildings. The limited value is used to figure your tax bill. It can only go up 5% per year under Arizona law.

Contact the assessor at (928) 373-6040. The office is at 197 S. Main Street in Yuma, AZ 85364. Email works too. Send messages to assr-info@yumacountyaz.gov. Staff can explain how they set your value. They can tell you about sales data used in the process. The office keeps records on every parcel in the county. This includes lot size, building type, year built, and more.

If you think your value is too high, you can file an appeal within 60 days of when the notice was mailed. Use ADOR Form 82130 to start the process. The assessor reviews your claim and may agree to lower the value. Under ARS 42-16051, you can file a formal petition if you still disagree after talking to them.

Yuma County Treasurer for Yuma City

The Yuma County Treasurer sends out Yuma tax bills each September. David Alexandre is the current treasurer. Bills are due in two halves. The first half is due October 1. It goes delinquent if not paid by November 1 at 5 p.m. The second half is due March 1 and turns delinquent after May 1 at 5 p.m. You can also pay the full year by December 31.

Call the treasurer at 928-539-7781 with billing questions. Email treasury@yumacountyaz.gov for help. The website lets you look up your bill and pay online any time. The online payment portal accepts cards and e-checks. Fees may apply based on your payment method. E-check usually costs less than credit cards.

Phone payments work well if you prefer talking to someone. Call 1-877-690-3729 and use Jurisdiction Code 1311 to reach the Yuma County payment line. Have your parcel number and payment info ready. The automated system takes cards and can process your payment in minutes. You can also pay in person at the Main Street office in downtown Yuma.

Note: Late payments cost 16% interest per year. A $3,000 tax bill would add $40 in interest the first month alone. Pay on time to avoid these charges.

Yuma Property Tax Values

Arizona uses two values for property tax purposes. The Full Cash Value shows what the property would sell for. The Limited Property Value is used to figure your actual tax bill. Under state law, the limited value can only go up 5% per year. This helps protect owners from big tax jumps when home prices rise fast.

The assessment ratio matters too. Homes use a 10% ratio in Arizona. That means if your limited value is $200,000, the assessed value is $20,000. Tax rates are then applied per $100 of assessed value. So a rate of $10 per $100 on that home would mean a $2,000 tax bill. Different tax districts overlap in Yuma. Schools, fire districts, and other local bodies each add their own rate. Your total bill depends on where your property sits within city limits.

Yuma property owners should check both values on their Notice of Value each year. The full cash value affects what happens if you sell. The limited value affects your tax bill. Both can be appealed if you think they are wrong. Just act fast because you only have 60 days from the mailing date to start an appeal.

Yuma Property Tax Exemptions

Yuma residents may qualify for property tax exemptions through Yuma County. Veterans with a 100% service-connected disability can get a full exemption on their primary home. This rule went into effect January 1, 2026. Other veterans with disability ratings may qualify for partial exemptions under ARS 42-11111.

The Senior Freeze Program helps older homeowners on fixed incomes. If you meet the age and income rules, your property value gets locked for three years. Your taxes stay flat even if home prices rise around you. Apply through the county assessor using ADOR Form 82104. Widows, widowers, and people with total permanent disabilities can also claim exemptions.

Exemptions do not happen by default. You must apply for them. Contact the Yuma County Assessor at (928) 373-6040 to find out if you qualify. Missing the deadline means waiting another year. If you think you might qualify, ask sooner rather than later.

Property Tax Appeals in Yuma

Think your Yuma property is worth less than the assessed value? You can appeal. The process starts with the county assessor. File your appeal within 60 days of when the Notice of Value was mailed. Use ADOR Form 82130 for real property. The form asks you to explain why you think the value is wrong. Include any proof you have like recent sales data or photos of property problems.

The assessor will review your claim. They may agree and lower the value. If they do, the case is closed. If you still disagree after the assessor decision, you have more options. Within 25 days you can appeal to the County Board of Equalization. The Arizona State Board of Equalization oversees this process. You can also skip the board and go to Tax Court within 60 days.

Keep good records when you appeal. Photos, repair bills, and sale prices from nearby homes all help your case. The board acts like a judge. They look at the facts both sides present. Their goal is to set a fair value on your property. Be ready to explain your position clearly at the hearing.

City of Yuma Contact

While the county handles property taxes, the City of Yuma can help with general questions about city services. The main number is (928) 373-5000. City Hall is at One City Plaza, Yuma, AZ 85364. Office hours run Monday through Thursday from 7 a.m. to 5 p.m. The city is closed on Fridays.

For property tax matters, always contact the county offices first. The city does not have access to tax records or payment systems. City staff will direct you to the county assessor or treasurer based on your question. The county offices are just a short drive from city hall on Main Street in downtown Yuma.