Pima County Property Tax Records

Pima County property tax records give you full details on any parcel in southern Arizona. The county treasurer and assessor both keep public files you can search at no cost. You can look up assessed values, view tax bills, check payment status, and see ownership data for over 450,000 parcels in the county. Most of this is online now, so you do not have to drive to Tucson to get what you need. The treasurer mails tax bills in mid-September each year. The assessor sends Notices of Value in February. Both offices sit at 240 N. Stone Avenue in downtown Tucson and share the same hours.

Pima County Property Tax Quick Facts

Pima County Treasurer Property Tax Office

The Pima County Treasurer collects all real and personal property taxes in the county. The office sends out tax bills, takes payments, and tracks who has paid or not. You can reach them at 240 N. Stone Avenue in Tucson, Arizona 85701. The phone number is (520) 724-8341. You can also send a fax to (520) 724-8344 or email treasurer@pima.gov with questions about your bill. Office hours run Monday through Friday from 8:00 AM to 5:00 PM MST.

Tax statements for the current year go out in mid-September. Each bill has two coupons, one for the first half and one for the second half of the year. You can pay both at once or split them up. The first half is due October 1 and becomes delinquent after November 1 at 5 p.m. The second half is due March 1 and delinquent after May 1 at 5 p.m. If you want to pay the full year in one shot, do it by December 31 to skip any interest charges. This is the same schedule used across all Arizona counties.

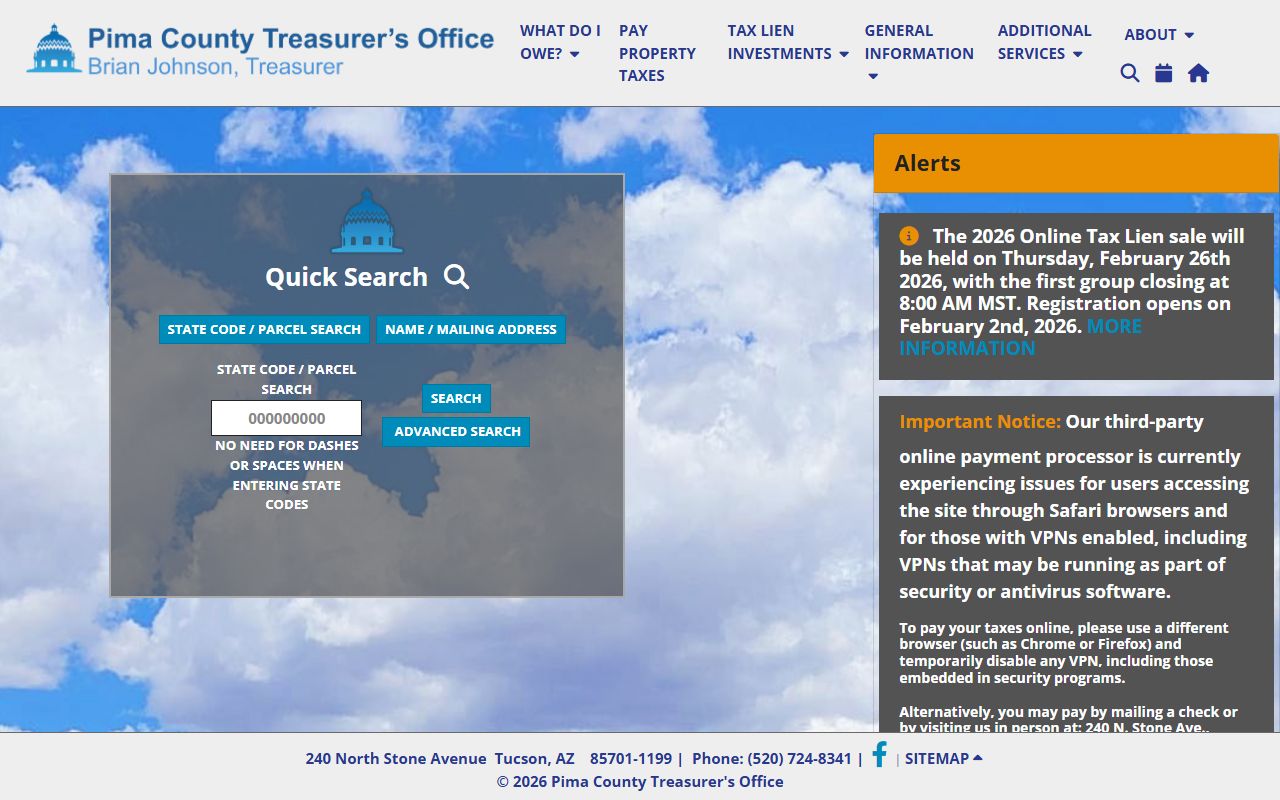

The Pima County Treasurer website lets you look up your tax bill and pay online at any hour. Here is the main page of the treasurer site.

From the treasurer site you can search by parcel number, property address, or owner name. The system shows your current bill, past due amounts, and payment history going back several years.

Pima County Property Tax Payment Options

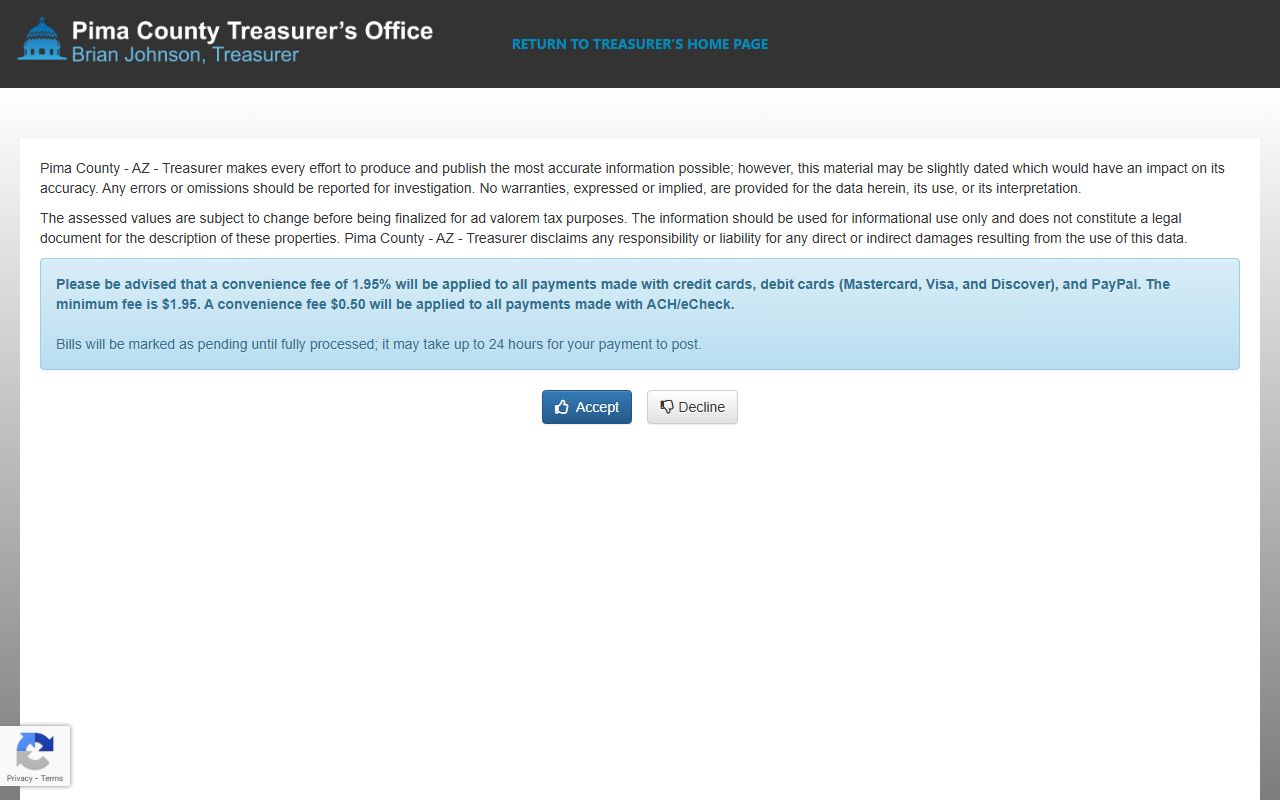

You have several ways to pay property taxes in Pima County. Online payments are the most popular since you can do them any time. The county uses a separate payment portal at PayPimaGov for online transactions. This site handles eChecks, credit cards, and debit cards. Fees vary by payment type. An eCheck costs just $0.50. Credit and debit cards have a 1.95% fee added to your payment amount.

The treasurer office also takes payments in person at their downtown Tucson location. Cash, check, and card payments are all accepted at the counter. In-person card payments have a 2% fee, which is slightly higher than the online rate. If you mail a check, send it early enough to arrive before the due date. The payment must be in their hands by 5 p.m. on the deadline, not just postmarked. A late payment triggers the 16% annual interest right away. That works out to 1.333% per month on whatever you owe.

This screenshot shows the online payment portal for Pima County taxes.

The payment site walks you through each step. Enter your parcel number or address to pull up the bill, then pick your payment method and submit.

Note: Partial payments are accepted but must be at least $10 and will be applied to the oldest taxes first.

Pima County Assessor Property Tax Records

The Pima County Assessor sets the value of all taxable property in the county. Assessor Suzanne Droubie leads this office. You can reach the assessor at (520) 724-8630. The office sits at 240 N. Stone Avenue in Tucson, the same building as the treasurer. Hours are Monday through Friday from 8:00 AM to 5:00 PM. The assessor website has tools to search property data and look up values.

Each year the assessor mails a Notice of Value to every property owner. This notice arrives in February. It shows two key numbers. The Full Cash Value is what your property would sell for on the open market. The Limited Property Value is used to calculate your actual tax bill. Under Arizona law, the limited value can only rise 5% per year from the prior year. This rule shields owners from big jumps in their tax bill when home prices spike. If you think the assessed value is too high, you have 60 days from the mailing date to file an appeal with the assessor using the proper state forms.

This is the main page of the Pima County Assessor website.

Assessor records include parcel maps, legal descriptions, building data, land use codes, and sales history. All of this is public and free to search.

Search Pima County Property Tax Records Online

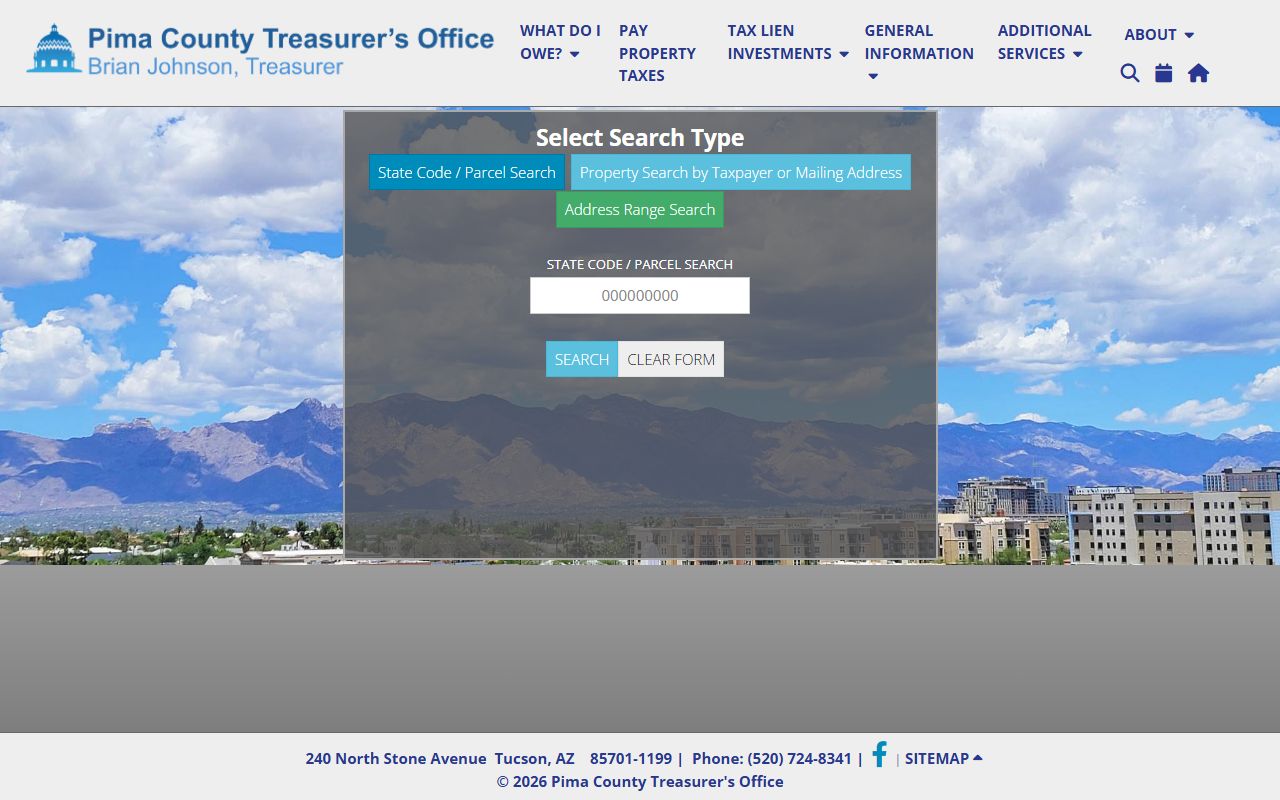

The treasurer runs a free property search tool on the county website. You can find any parcel by typing in the address, owner name, or parcel number. The search results show current tax amounts due, payment status, and basic property info. This tool is the fastest way to check if taxes have been paid on a property you want to buy. It also lets you look at tax history for past years.

Here is a look at the property search database interface.

The search is simple to use. Type your info and hit enter. Results come up fast and include links to the full parcel record.

Pima County Property Tax Information

Pima County government has a general property tax information page that explains how the system works. This page covers the basics of how values are set, how bills are calculated, and where to go for help. It is a good starting point if you are new to property taxes in the area or just moved to Tucson from another state.

Property tax rates in Pima County come from several taxing districts. Schools take the biggest share. Fire districts, community colleges, and special improvement areas also add to the bill. The county itself collects a portion too. Each district sets its own rate. The total rate depends on which districts your property sits in. A home in Tucson pays different rates than one in Oro Valley or Marana. The assessor website can show you which districts apply to any given parcel.

Understanding your tax bill can feel confusing at first. The county page breaks it down into plain terms. It covers what each line item means and how the math works from assessed value to final bill.

Pima County Delinquent Property Taxes

Missing a property tax deadline in Pima County is costly. State law says interest starts to accrue at 16% per year once the due date passes. That rate is prorated monthly at 1.333%. It does not matter if you pay on the last day of the month or the first day. The full month of interest gets charged either way. On a $5,000 tax bill, you would owe about $67 in interest for each month you are late. That adds up fast over time.

If taxes stay unpaid through the end of the year, more penalties apply. The county adds either $5 or 5% of the amount due, whichever is greater. They then publish your name and property in local newspapers as delinquent. A lien goes on the property in February. Under Arizona law, this lien takes priority over almost all other claims. If you try to sell or refinance, the lien must be paid first. The county holds tax lien sales each year to let investors pay off delinquent taxes in exchange for the interest.

Note: If you cannot pay the full amount, the treasurer will still accept partial payments of at least $10 toward your balance.

Appeal Pima County Property Tax Values

You can challenge your property value if you believe it is too high. The appeal process starts with the Pima County Assessor. File a Petition for Review within 60 days after the Notice of Value was mailed. Use ADOR Form 82130 for real property or Form 82530 for personal property. Describe why you think the value is wrong. Include any evidence you have, like recent sales of similar homes or an appraisal.

The assessor will review your petition and respond. If they agree, the value gets lowered. If they deny your appeal, you have options. You can file with the Pima County Board of Equalization within 25 days of the assessor's decision. The board acts like a small court. They hear evidence and can change your value or classification. Another option is to skip the board and go straight to Arizona Tax Court within 60 days. Most people try the board first since it is cheaper and faster. The State Board of Equalization oversees the process statewide.

Personal property owners have a shorter window. You only get 30 days from the Notice of Value to appeal business equipment and other personal property. The forms and process are similar, but the clock ticks faster.

Pima County Property Tax Exemptions

Arizona offers several ways to lower or eliminate your property tax bill if you qualify. Veterans with a 100% service-connected disability can get a full exemption on their primary home. This rule went into effect January 1, 2026. Other disabled veterans may qualify for partial exemptions based on their rating. Widows, widowers, and people with total permanent disabilities also have exemption options. Apply at the Pima County Assessor office with proof of your status.

The Senior Freeze Program helps older residents on fixed incomes. It locks your property value for three years so your taxes stay flat even if home prices rise around you. You must meet both age and income requirements. The assessor handles applications. This program can provide real relief for seniors worried about property taxes pushing them out of their homes in a rising market.

Pima County Property Taxes by City

Property taxes in Arizona cities are collected by the county, not the city. If you live in Tucson, Oro Valley, Marana, or any other Pima County city, you pay your taxes through the Pima County Treasurer. The city sets part of your tax rate, but all billing and collection goes through the county office. This makes it easier since you only deal with one place for payment.

Tucson is the largest city in Pima County and the county seat. It is also the second largest city in Arizona. Most Pima County parcels are in or near Tucson. The city has its own property tax rate that appears on your bill alongside school district rates, fire district rates, and county rates. To look up tax records for a Tucson property, use the Pima County search tools shown above.

Nearby Arizona Counties

Pima County borders several other Arizona counties. If you own property near the edge of Pima County, the neighboring county handles that parcel's taxes. Each county has its own assessor and treasurer offices with their own search tools and payment systems. Make sure you are looking at the right county for your property.

Counties that border Pima County include:

- Pinal County to the north

- Santa Cruz County to the south

- Cochise County to the east

- Graham County to the northeast

If your property sits on or near a county line, double check which county it is in before searching tax records. The parcel number will tell you. Pima County parcels start with specific prefixes that differ from other counties.

View All Arizona Counties Back to Arizona Property Tax Records