Santa Cruz County Tax Records

Santa Cruz County property tax records are public files you can access through the county assessor and treasurer offices in Nogales. This border county sits at the south end of Arizona, right next to Mexico. You can search tax bills, check assessed values, find payment history, and look up parcel data for any land in the county. The assessor sets property values each year while the treasurer handles billing and collection. Both offices sit in the same building at 2150 N. Congress Drive in Nogales. Online tools let you search records from home any time.

Santa Cruz County Property Tax Quick Facts

Santa Cruz County Assessor Office

The Santa Cruz County Assessor sets the value of all taxable property in the county. Assessor Pablo A Ramos leads this office. You can reach them at (520) 375-8030. The office is at 2150 N. Congress Drive, Room 102, in Nogales, Arizona 85621. Stop by during business hours to get help with value questions, exemption forms, or appeal paperwork.

Each February the assessor mails a Notice of Value to every property owner in Santa Cruz County. This card shows two key numbers for your land. The Full Cash Value tells you what the property would sell for on the open market. Under ARS 42-11001, full cash value means market value unless a formula says otherwise. The Limited Property Value is the number used to figure your actual tax bill. State law caps how fast the limited value can rise. It goes up just 5% per year at most under ARS 42-13301. This rule keeps tax bills from jumping too fast when home prices spike in the border region.

You can view the Santa Cruz County Assessor and Treasurer office pages on the county website. Below is a screenshot showing these county office pages.

Assessor records contain a lot of useful data about each parcel. You can find legal descriptions, lot sizes, building details, and ownership history. All of this info is public record in Arizona.

Santa Cruz County Treasurer Tax Bills

The Santa Cruz County Treasurer collects all real and personal property taxes in the county. The office sends out bills, takes payments, and tracks who has paid. You can reach the treasurer at (520) 375-7980. The office is at 2150 N. Congress Dr. Room 104 in Nogales, Arizona 85621. This is the same building as the assessor, just down the hall.

Tax bills go out in September each year. The bill shows your total tax amount split into two halves. The first half is due October 1. It becomes delinquent if not paid by 5 p.m. on November 1. The second half is due March 1 and delinquent after May 1 at 5 p.m. You can also pay the full year at once by December 31 to avoid interest. These deadlines match the standard Arizona property tax calendar that all 15 counties follow.

Once you miss a deadline, interest starts to add up at 16% per year. That rate is prorated monthly at about 1.33%. On a $2,000 tax bill, you would owe roughly $27 in interest for each month you are late. The county also adds a $5 or 5% penalty if taxes stay unpaid past December. A tax lien then goes on the property in February. Under ARS 42-17153, this lien takes priority over almost all other claims on the land.

Note: For 2023/2024 property taxes, Santa Cruz County requires certified funds only. This means cash, money order, or cashier check. Personal checks may not be accepted for back taxes.

Search Santa Cruz County Property Tax Records

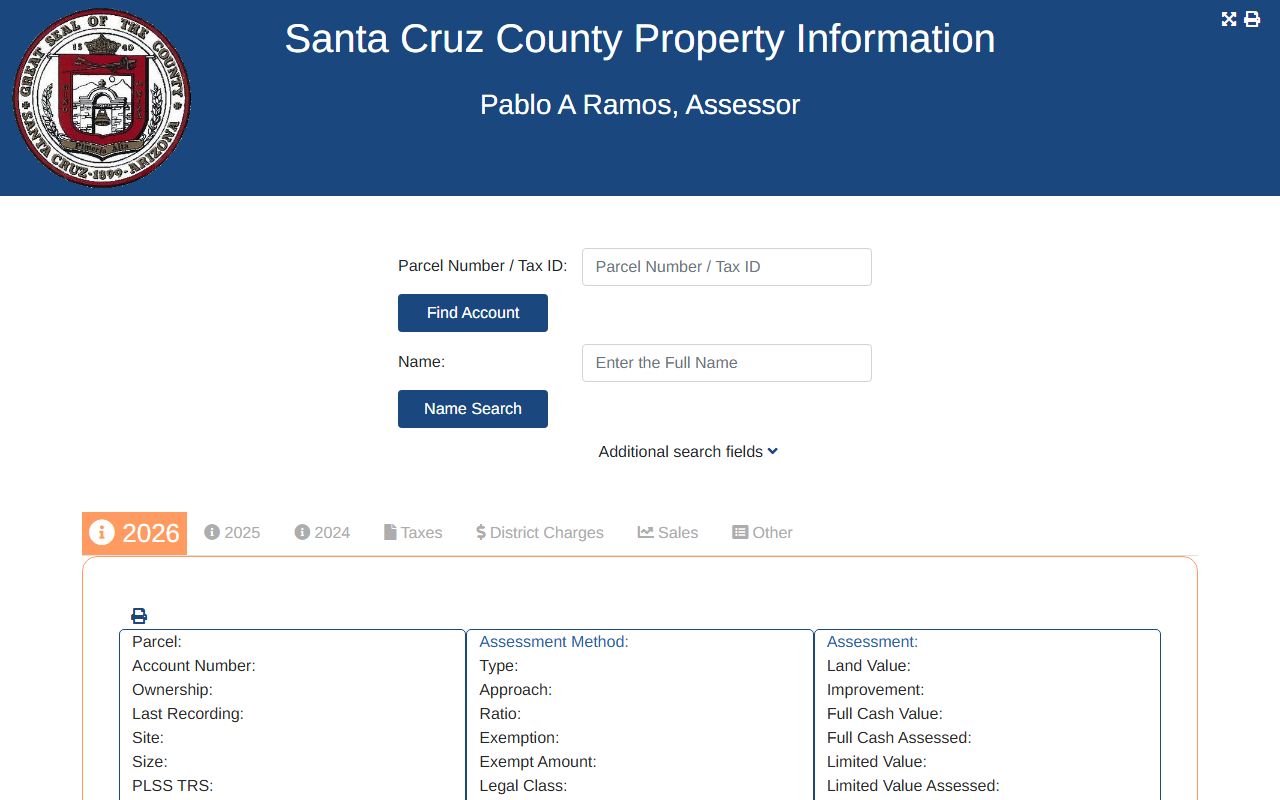

Santa Cruz County has an online search tool that lets you look up any parcel in the county. The property search portal is free to use. You can search by parcel number, owner name, or property address. Results show assessed values, tax amounts owed, and payment status. This is the fastest way to check tax records without driving to Nogales.

Below is a screenshot of the Santa Cruz County property search database.

The search tool is simple to use. Type in your info and hit enter. Results come up fast. You can see current taxes due, past payments, and basic parcel info all in one place. The system also lets you view and print tax bills for your records.

How Santa Cruz County Property Tax Works

Property tax in Santa Cruz County follows the same rules as the rest of Arizona. The Arizona Department of Revenue sets the policy, but counties do the real work. Your tax bill depends on two things. First is the assessed value set by the assessor. Second is the tax rate set by various districts.

Tax rates in the county come from several sources. School districts take the biggest share in most cases. The county government adds its own rate. Fire districts, community college districts, and special improvement areas may add more. Each parcel sits in specific taxing districts. A home in Nogales pays different rates than a ranch in Patagonia or Rio Rico. The total rate for your parcel shows up on your tax bill each year.

The math works like this. The assessor takes the Limited Property Value and multiplies it by 10% for homes. That gives you the assessed value. Then each taxing district applies its rate per $100 of assessed value. Add them all up and you get your tax bill. A home with a $200,000 limited value would have a $20,000 assessed value. If the combined rate is $10 per $100, the tax bill would be $2,000 for the year.

Appeal Santa Cruz County Property Values

You can challenge your property value if you think it is wrong. The appeal process starts with the Santa Cruz County Assessor. File a Petition for Review within 60 days after the Notice of Value was mailed. Use ADOR Form 82130 for real property. Get the form from the Arizona Department of Revenue forms page. Describe why you think the value is too high. Bring evidence like recent sales of similar homes or a current appraisal.

The assessor reviews your petition and responds. If they agree, the value drops. If they deny your claim, you have more options. You can file with the Santa Cruz County Board of Equalization within 25 days of the assessor's decision. The State Board of Equalization oversees this process across Arizona. The county board acts like a small court. They hear evidence and can change your value or property class.

Another path is to skip the board and go straight to Arizona Tax Court. You have 60 days from the assessor's decision to file there. Most people try the county board first since it costs less and moves faster. Personal property owners get a shorter window. You only have 30 days from the Notice of Value to appeal business equipment and other personal property under ARS 42-16051.

Santa Cruz County Tax Exemptions

Arizona offers ways to cut your property tax bill if you qualify. Veterans with a 100% service-connected disability can get a full exemption on their primary home. This rule went into effect January 1, 2026. Other disabled veterans may get partial exemptions based on their rating. Widows, widowers, and people with total permanent disabilities also have exemption options under ARS 42-11111.

The Senior Freeze Program helps older residents on fixed incomes. It locks your property value for three years. Your taxes stay flat even if home prices rise around you. You must meet age and income rules to qualify. Apply at the Santa Cruz County Assessor office with the proper state forms. This program can give real relief to seniors worried about rising tax bills pushing them out of their homes in the border region.

Pay Santa Cruz County Property Taxes

You have several ways to pay property taxes in Santa Cruz County. The treasurer office accepts payments in person at their Nogales location during business hours. For current year taxes, you can pay by check, cash, or card at the counter. Online payments are also available through the county website. The property search portal links to the payment system.

Keep in mind the special rule for back taxes. If you are paying 2023/2024 property taxes or older, the county requires certified funds. That means cash, money order, or cashier check. They will not accept personal checks for delinquent amounts. This policy helps the county avoid bounced checks on past due accounts. If you owe back taxes, call the treasurer office at (520) 375-7980 to confirm what payment forms they will take for your specific situation.

Mailed payments must arrive by the due date to avoid interest. Postmarks do not count. The payment must be in their hands by 5 p.m. on the deadline. Send checks early if you use the mail option.

Santa Cruz County Property Tax Deadlines

Property tax in Santa Cruz County follows a yearly cycle with set dates. Mark these on your calendar:

- February: Notice of Value mailed by the assessor

- 60 days after notice: Deadline to appeal real property values

- September: Tax bills mailed by the treasurer

- October 1: First half taxes due

- November 1 at 5 p.m.: First half becomes delinquent

- December 31: Last day to pay full year without interest

- March 1: Second half taxes due

- May 1 at 5 p.m.: Second half becomes delinquent

Missing a deadline costs money. The 16% annual interest rate adds up to more than $133 per month for every $10,000 you owe. If taxes stay unpaid past the year, penalties and liens follow. Stay on top of these dates to avoid extra charges on your Santa Cruz County tax bill.

Nearby Arizona Counties

Santa Cruz County borders two other Arizona counties. If you own property near the county line, the neighboring county handles that parcel's taxes. Each county has its own assessor and treasurer with their own search tools and payment systems. Double check which county your property is in before paying.

Counties that border Santa Cruz County:

- Pima County to the north and west

- Cochise County to the east

Santa Cruz County also borders Mexico to the south. The Nogales border crossing is one of the busiest ports of entry in Arizona. This gives the county a unique character that affects property values and tax rates in the region.

View All Arizona Counties Back to Arizona Property Tax Records