Cochise County Property Tax Records

Cochise County property tax records are kept by two main offices in Bisbee. The County Assessor sets values on all land and buildings. The County Treasurer sends out bills and takes payments. You can search these records online or visit the offices on Melody Lane in person. Both offices have web tools that let you look up any parcel in the county by address, owner name, or parcel number. Cochise County sits in the southeast corner of Arizona, next to the New Mexico state line and the Mexico border. The county seat is Bisbee, where both tax offices are located.

Cochise County Property Tax Quick Facts

Cochise County Assessor Property Tax Records

The Cochise County Assessor is Phil Leindecker. His office finds and values all taxable property in the county. This includes homes, land, commercial buildings, and mobile homes. The assessor staff also handles business personal property like equipment and machinery. Each year they mail a Notice of Value to every property owner. This notice shows two key figures: the Full Cash Value and the Limited Property Value.

Full Cash Value is what the property would sell for on the open market. It tells you the market price based on recent sales and property features. The Limited Property Value is different. Under Arizona law, it can only go up 5% per year from the prior value. This rule keeps your tax bill from spiking when home prices jump. Your actual tax bill is based on the Limited Property Value, not the Full Cash Value. This matters a lot in years when real estate prices rise fast.

You can reach the Cochise County Assessor by phone at (520) 432-8650. The office is at 1415 Melody Lane, Building B in Bisbee. Hours are standard county business hours. You can also search property records online through their web portal. The Cochise County Assessor website has links to parcel search tools and contact information.

The assessor site provides basic info about office services and hours. From there you can access the online property search database to look up any parcel in Cochise County.

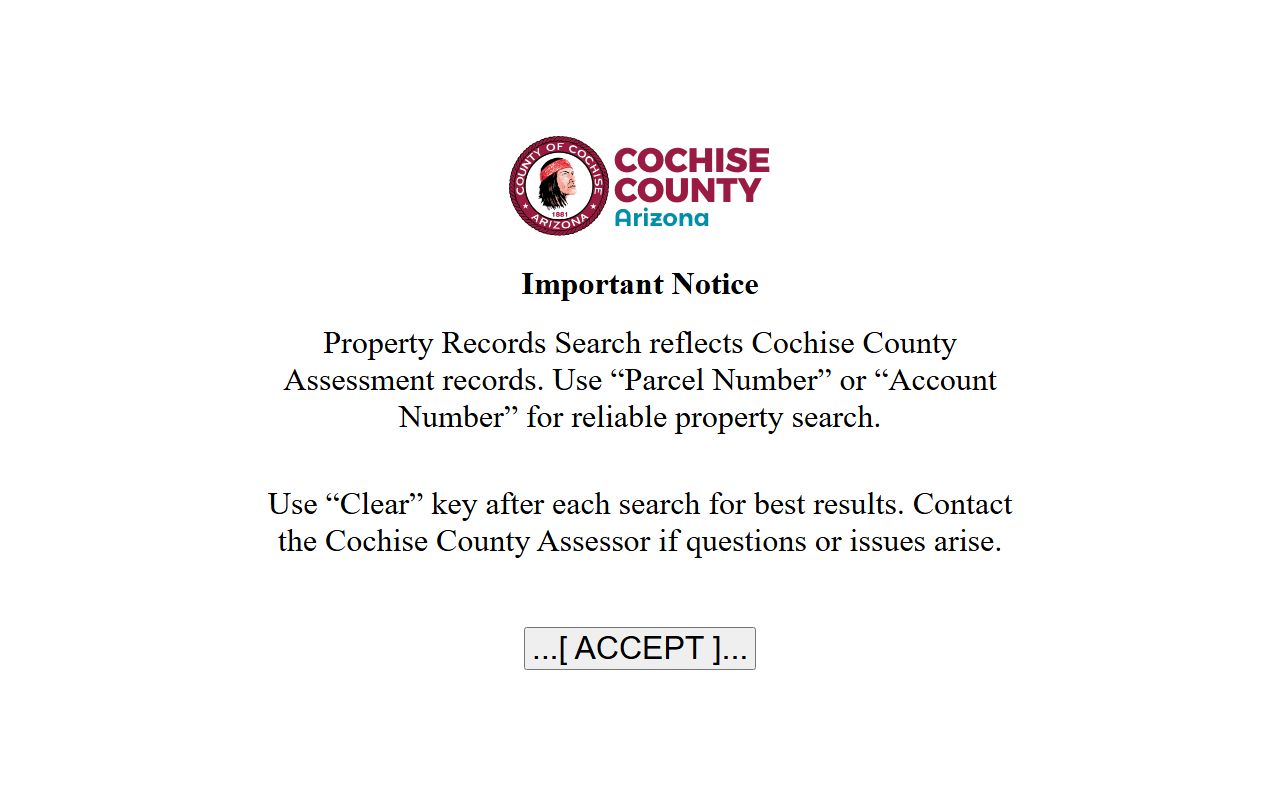

Cochise County Property Records Search

Cochise County offers a free online database where you can search property tax records at any time. The system lets you look up parcels by owner name, property address, or parcel number. You can see assessed values, legal descriptions, property characteristics, and ownership history. This is the same data the assessor uses to set your tax value.

The Cochise County property records database is easy to use. Type in an address and hit search. The results show the parcel number, owner name, and current assessed values. Click on a parcel to see more details. You can find lot size, building square footage, year built, and sale history. The site also shows the property class, which affects the assessment ratio used for taxes.

This search tool is free. No account needed. You can look up any property in the county, not just your own. Real estate agents, title companies, and buyers use this tool all the time to check values before making offers. The data updates regularly to reflect new sales and value changes.

Note: The assessor database shows property values, not tax bills or payment status. For tax bills and payment history, use the treasurer site instead.

Cochise County Treasurer Tax Records

The Cochise County Treasurer is Catherine L. Traywick. Her office handles tax bills and payments for all property in the county. Each September they mail tax statements to every property owner. The bill shows what you owe, when it is due, and how to pay. The treasurer office also tracks payment history and handles delinquent accounts.

You can reach the Cochise County Treasurer at (520) 432-8400. The office is at 1415 Melody Lane, Building E in Bisbee. That is the same Melody Lane complex where the assessor sits, just a different building. For questions about back taxes or liens, you can email treasurerbacktax@cochise.az.gov. The Cochise County Treasurer website has forms, payment options, and contact details.

The treasurer site lists office hours, payment methods, and links to online services. You can find info about tax sales and delinquent property here too.

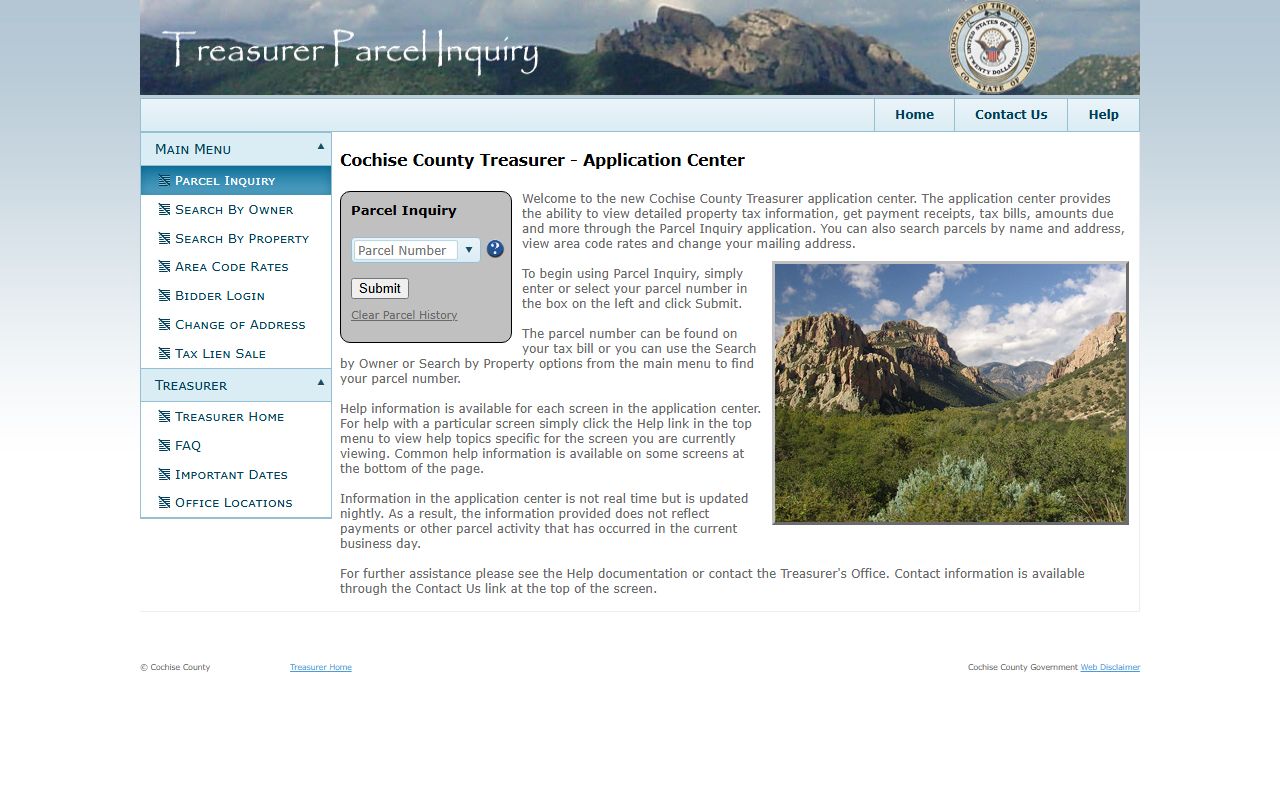

Cochise County Property Tax Payments

You can pay Cochise County property taxes in several ways. The county accepts payments online, by mail, or in person at the treasurer office in Bisbee. Online payments are handy because you can pay from home any time of day. The treasurer uses the Cochise County parcel inquiry system to let you look up your bill and pay right there.

The parcel inquiry tool shows your current tax bill, any past due amounts, and payment history. You can pay with a credit card, debit card, or e-check. Each payment method has a fee:

- Credit card: 2.19% of the payment, with a $2 minimum fee

- Debit card: 1% of the payment, with a $1 minimum fee

- E-check: $1 flat fee no matter the amount

E-check is the cheapest option for large tax bills. If you owe $3,000 in taxes, a credit card fee would be about $66. An e-check fee is just $1. For small bills the difference is less, but it still adds up over the years. You can also mail a check to the treasurer office or pay in person with cash or check. Mailed payments should go out early to arrive before the deadline.

Note: Online payment fees go to the payment processor, not the county. The county does not profit from these fees.

Cochise County Tax Deadlines

Property taxes in Cochise County follow the same schedule as all Arizona counties. The first half is due October 1. If you miss that date, you have until November 1 at 5 p.m. before it goes delinquent. The second half is due March 1 and becomes delinquent after May 1 at 5 p.m.

You can pay the full year at once if you want. Just pay by December 31 to avoid any interest. This is a good option if you have the cash on hand. It saves you from having to remember the March deadline. Missing a deadline costs you money. The interest rate is 16% per year, charged monthly at about 1.33%. On a $2,000 tax bill, that is roughly $27 per month in added charges.

If taxes stay unpaid past January of the next year, things get worse. The county adds a $5 fee or 5% of the amount due, whichever is more. They publish your name and property in the local paper. A lien goes on the property. Eventually the county can sell the tax lien to an investor who then has a claim on your land. Tax lien sales happen each February in Arizona. The best way to avoid all this is to pay on time.

Property Tax Appeals in Cochise County

If you think your Cochise County property value is wrong, you can appeal. Start with the assessor. File your appeal within 60 days of getting the Notice of Value. Use ADOR Form 82130 for real property. The assessor will review your case. They may agree and lower the value. If they do, your tax bill goes down too.

What if the assessor says no? You have two choices. First, you can appeal to the Cochise County Board of Equalization within 25 days of the assessor's decision. The board acts like a judge. They hear your case and can change the value if you prove your point. Second, you can skip the board and go straight to Arizona Tax Court within 60 days of the assessor's decision. Tax Court costs more and takes longer, so most people try the board first. The Arizona State Board of Equalization website has forms and instructions for the appeal process.

Good evidence helps your appeal. Bring photos of problems with your property. Show sales of similar homes that sold for less than your assessed value. Point out errors in the property record, like wrong square footage or lot size. The more facts you have, the better your odds. Even if you lose, you can still pay your taxes under protest and keep fighting in court.

Cochise County Property Tax Exemptions

Some Cochise County property owners can get tax breaks. Veterans with a 100% service-connected disability rating pay no property tax on their home. This full exemption started January 1, 2026. Other disabled veterans may get partial relief based on their rating. Widows, widowers, and people with total permanent disabilities can also apply for exemptions. Check ARS 42-11111 for the full rules.

The Senior Freeze Program helps older residents keep their taxes steady. If you qualify, the assessor locks in your property value for three years. Even if home prices go up, your value stays the same. This keeps your tax bill from rising. You must meet age and income limits to get in. Apply at the Cochise County Assessor office using ADOR Form 82104. The assessor staff can tell you if you qualify based on your age and income.

Nearby Arizona Counties

Cochise County borders several other Arizona counties. If you own property in more than one area, you may need to deal with multiple assessor and treasurer offices.

Counties near Cochise County include Pima County to the west, Santa Cruz County to the southwest, Graham County to the north, and Greenlee County to the northeast. Each county has its own tax rates and fees. The assessor and treasurer contact info differs in each place. Use the links above to find property tax records in those counties.