Find Navajo County Tax Records

Navajo County property tax records give you data on assessed values, tax bills, and payment history for parcels in northeastern Arizona. The county seat sits in Holbrook along Interstate 40. You can search these records through the county's online portal or visit the assessor and treasurer offices at 100 East Code Talkers Drive. Both offices hold records on all taxable land and buildings in the county. Staff can help you pull up any parcel by address or parcel number during regular hours. Online tools let you search from home at any time and pay your bill with a few clicks.

Navajo County Property Tax Quick Facts

Navajo County Assessor Office

The Navajo County Assessor's Office values all real and personal property for tax purposes. Mike Montandon serves as the current county assessor. You can reach him at (928) 524-4095. The main office line is (928) 524-4086. The office is at 100 East Code Talkers Drive in Holbrook, AZ 86025. Staff work to find and value every taxable parcel in the county each year. They set the Full Cash Value and Limited Property Value that show up on your Notice of Value each February.

The Navajo County Assessor website has forms, tax data, and contact info. You can learn about exemptions and appeals there. The site also links to online search tools where you can look up any parcel.

Arizona law says your Limited Property Value can rise by at most 5% each year. This rule, found in ARS 42-13301, keeps your tax bill from jumping too much when home prices go up fast. The Full Cash Value may match the market, but taxes are based on the limited value in most cases. The assessor sends out notices by early March. Check your notice and make sure the info looks right. If the value seems too high, you can file an appeal within 60 days of the mailing date.

Navajo County Treasurer Tax Payments

The Navajo County Treasurer's Office collects all property taxes in the county. Danielle Earl is the current treasurer. Call (928) 524-4172 or email treasurer@navajocountyaz.gov for help with your bill. The Navajo County Treasurer website has payment info and links to the online system. Tax bills go out in September each year. You can pay in full or split it into two halves.

Payment deadlines in Navajo County match the rest of Arizona. First half is due October 1. It becomes late if not paid by November 1 at 5 p.m. Second half is due March 1 and late after May 1 at 5 p.m. You can pay the whole year by December 31 if you prefer one payment. Once taxes go late, interest starts at 16% per year. That works out to about 1.33% each month on the amount you owe. Pay on time to skip these extra costs.

The treasurer takes cash, checks, and card payments. You can pay in person at the Holbrook office or use the online portal. Card payments may have a small fee. E-check is often cheaper. Call ahead if you are not sure which method works best for you.

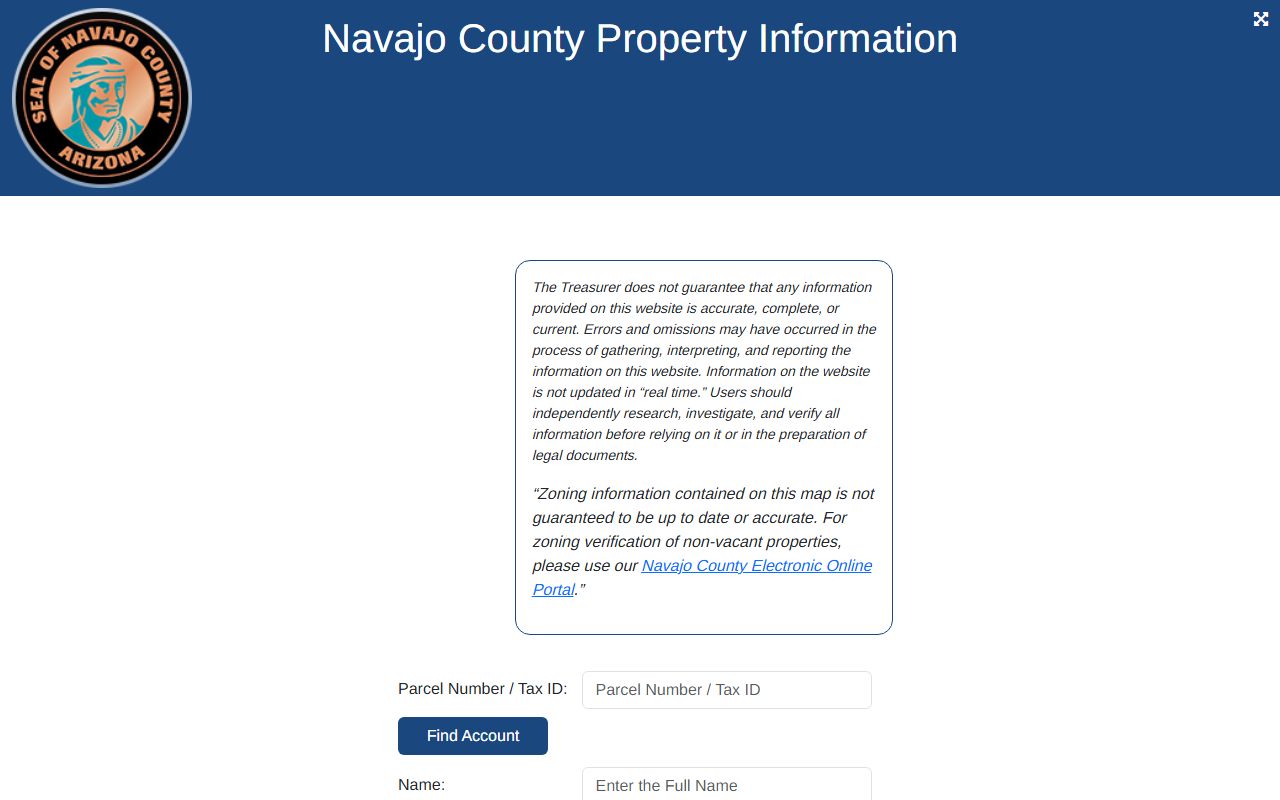

Search Navajo County Property Tax Records Online

Navajo County runs an online portal to search property records. The Navajo County Property Information page lets you look up any parcel. Type in an address, owner name, or parcel number to find the record you need. The system shows the assessed value, tax bill amount, and payment status. You can use it any time from your home computer or phone.

The online data comes from both the assessor and treasurer offices. You can see the legal description, lot size, and building details. Tax history shows past bills and whether they were paid on time. Current year balances update as payments come in. If you spot an error or need official copies, contact the county offices directly. The online search is free and open to everyone.

Note: No account or login is needed to search basic property records on the county portal.

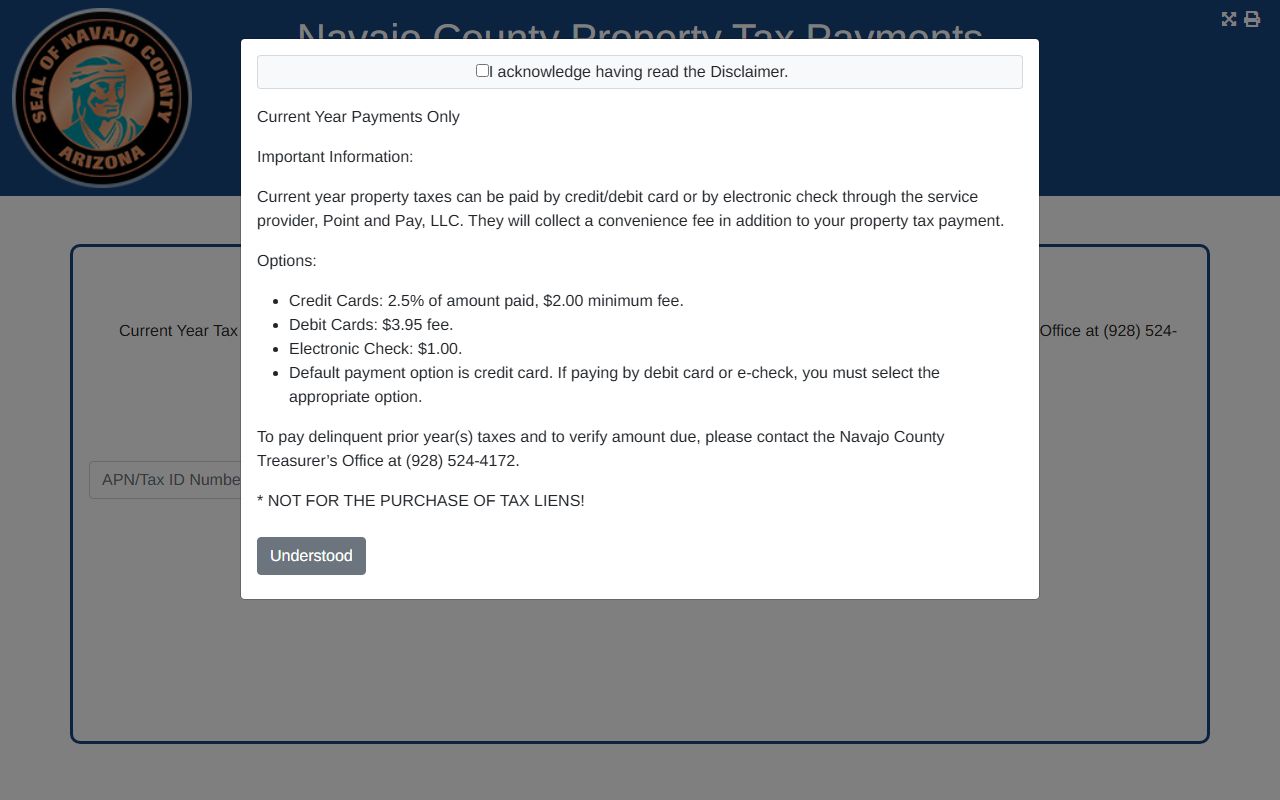

Pay Navajo County Property Taxes Online

The county makes it easy to pay your bill from home. Go to the Navajo County Pay Taxes portal to start. Enter your parcel number or search by name or address to find your account. The system shows your current balance and any past due amounts. You can pay part or all of what you owe in one session.

The portal accepts debit cards, credit cards, and e-checks. Card payments come with a fee that goes to the payment vendor. E-checks often cost less. A receipt shows up on screen once your payment goes through. Save or print it for your records. If you have trouble, call the treasurer's office for help at (928) 524-4172.

Navajo County Property Tax Appeals

Think your value is too high? You can file an appeal. The first step is to contact the Navajo County Assessor. Use ADOR Form 82130 for real property. You have 60 days from the date the Notice of Value was mailed. This deadline is firm. Late filings get turned away.

The assessor will review your claim. They may agree and lower the value. If not, you can take it to the next level. File with the County Board of Equalization within 25 days of the assessor's decision. The board acts as a neutral judge. They look at the facts you bring and make a ruling. The Arizona State Board of Equalization oversees this process. You may also skip the board and go straight to Tax Court within 60 days if you choose.

Good evidence helps your case. Bring sales data from similar homes, photos of damage, or repair estimates. The board wants to see why the value should be lower. Keep copies of all your paperwork. Know the deadlines and follow each step in order. Most appeals start at the county level since it costs less and moves faster than court.

Note: Personal property appeals have a shorter 30-day window instead of 60 days for real property.

Property Tax Exemptions in Navajo County

Arizona gives tax breaks to certain groups. Veterans with a 100% service-connected disability can get a full exemption on their home. This applies to Arizona residents under ARS 42-11111. Other veterans with lower ratings may get partial relief. Widows, widowers, and people with total permanent disabilities also have options. Apply through the Navajo County Assessor to see if you qualify.

The Senior Freeze Program helps older homeowners on fixed incomes. It locks in your property value for three years. Even if home prices rise, your assessed value stays flat. You must meet age and income limits to use this program. The assessor handles applications using ADOR Form 82104. Call (928) 524-4086 to ask about your eligibility. This program renews every three years if you still qualify.

How Navajo County Tax Rates Work

Your tax bill depends on two main things. One is your assessed value. The other is the tax rate set by local districts. Schools, fire districts, cities, and the county each set their own rates. These all add up to your total rate per $100 of assessed value. Homes use an assessment ratio of 10%. So a home with a $200,000 Limited Property Value has an assessed value of $20,000. Multiply by the rate to get your bill.

Different parts of Navajo County have different total rates. A home in a city pays city taxes plus county and school rates. A rural home might skip city taxes but still pay county, school, and fire district rates. Check your tax bill to see which districts apply to your parcel. The assessor's records show your tax area code. Each code links to a set of districts that tax that spot.

Arizona caps how fast your Limited Property Value can grow. It can only rise 5% per year under state law. This protects Navajo County homeowners when the market jumps. Your Full Cash Value may go up more, but your taxes use the limited value. This keeps your bill from spiking all at once. Long-time owners often see a big gap between their market value and limited value.

Navajo County Property Tax Deadlines

Know your dates to avoid late fees. Tax bills go out in September. First half is due October 1. If not paid by November 1 at 5 p.m., it goes late and interest starts. You can pay the full year by December 31 instead of splitting it. Second half is due March 1 and late after May 1 at 5 p.m.

The late interest rate is 16% per year. That comes to about $133 per month for every $10,000 in unpaid taxes. The county adds interest at the start of each month. If taxes stay unpaid into the next calendar year, a $5 or 5% penalty may also apply. Unpaid taxes get advertised in the local paper. A tax lien attaches to the property. Eventually, the county can sell the lien at auction. Buyers at the tax sale earn interest while you pay off the debt.

Appeal deadlines also matter. You have 60 days from the Notice of Value mailing to challenge your assessment. Miss that window and you lose your chance until next year. Mark your calendar when the notice comes in February or early March.

Accessing Navajo County Tax Records

Property tax records in Arizona are public. Anyone can view them. Under ARS 39-121, public records must be open to inspection during office hours. You can visit the Navajo County offices in Holbrook to look at records in person. Staff can pull up any parcel on their system and print copies if you need them. A small fee may apply for paper copies.

The online portals let you search from anywhere. You can look up property values, tax bills, and owner names without going to the office. These tools are free to use. Some people search records to check on a home before buying it. Others use them to see what neighbors pay in taxes. Investors look for tax liens or sales. Whatever your reason, the data is there for you to find.

If you need certified copies or official documents, contact the assessor or treasurer directly. Not all records are online. Older records or detailed files may require an in-person visit. Call ahead so staff can have the records ready when you arrive.

Nearby Arizona County Tax Records

Navajo County shares borders with other Arizona counties. If you own land near the edge or are looking at property in another area, you may need records from a different office. Each county has its own assessor and treasurer who keep tax records for their area.

To the east lies Apache County with offices in St. Johns. West of Navajo is Coconino County based in Flagstaff. South sits Gila County with main offices in Globe. Make sure you search the right county for the parcel you want. A property near the border may actually be in the next county over. Check the parcel number or address to confirm which county handles the taxes.

Contact Navajo County Tax Offices

Both offices are at 100 East Code Talkers Drive in Holbrook. Visit during business hours for in-person help. Staff can look up any parcel and explain values, bills, or payment options. Bring your parcel number or property address to speed things up.

Key contact info for Navajo County property tax questions:

- Assessor Mike Montandon: (928) 524-4095

- Assessor main office: (928) 524-4086

- Treasurer Danielle Earl: (928) 524-4172

- Treasurer email: treasurer@navajocountyaz.gov

- Address: 100 East Code Talkers Drive, Holbrook, AZ 86025

The offices follow standard government hours. They close on state holidays. If you cannot make it in person, call, email, or use the online tools. The county websites have forms you can download and mail if needed. Most questions about your bill or value can be answered by phone in a few minutes.