Apache County Property Tax Records

Apache County property tax records are held at the county offices in St. Johns, Arizona. You can search these records to find assessed values, tax amounts, and payment status for any parcel in the county. The assessor sets property values each year while the treasurer handles tax collection. Apache County makes many of these records free to search online through their EagleWeb system. Whether you own land near the Navajo Nation or in the White Mountains, you can look up tax data without driving to the courthouse. This guide shows you how to access Apache County property tax records and what to expect when you search.

Apache County Property Tax Quick Facts

Apache County Assessor Records

The Apache County Assessor is Rodger Dahozy. His office is at 75 West Cleveland Street in St. Johns. You can call them at (928) 337-7624. They work Monday through Thursday from 6:30 a.m. to 5:30 p.m. The office is closed on Fridays. This four-day schedule is common in rural Arizona counties.

The assessor finds and values all taxable property in Apache County. This includes homes, land, farms, and business equipment. Each year, the office mails a Notice of Value to every property owner. The notice shows two key numbers. The Full Cash Value is what your property would sell for on the open market. The Limited Property Value is used to figure your actual tax bill. Under Arizona law, the limited value can only go up 5% per year. This rule keeps your tax bill from jumping too fast when land prices rise. The limited value can never be more than the full cash value.

You can visit the Apache County Assessor website to learn about services and find contact info.

The assessor keeps detailed records on every parcel. You can find the legal description of any property. Maps show lot lines and acreage. Building records list things like square footage, year built, and how the structure was made. Sales data shows what nearby land sold for. All of this helps set fair values across the county.

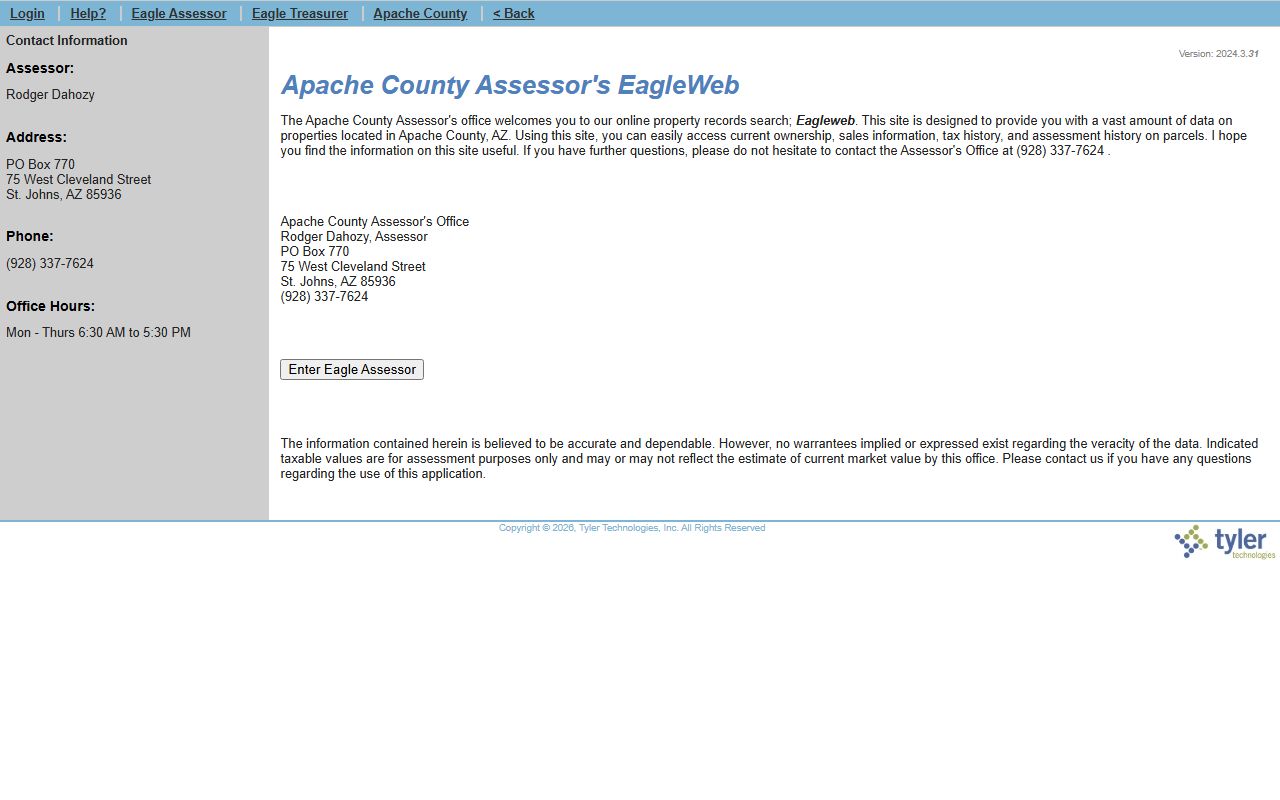

Search Apache County Property Tax Records Online

Apache County uses the EagleWeb system for online property searches. This tool lets you look up any parcel in the county at no cost. You can search by owner name, address, or parcel number. The results show assessed values, property details, and ownership info. Most people find what they need in just a few clicks.

To search Apache County tax records, go to the EagleWeb Assessor portal. Pick your search type and enter what you know about the property. The system works best when you have an exact address or parcel number. If you only have an owner name, try different spellings. The database may have the name listed in a way you did not expect. Results show the basic info on one page. Click through to see more details like building specs and value history.

The EagleWeb system covers assessor records. For tax payment info and bills, you need a different tool. The treasurer has a separate search portal that shows what you owe and what has been paid. Both systems are free to use.

Note: Online records may not reflect the most recent changes. For time-sensitive matters, call the office to confirm.

Apache County Treasurer Tax Records

The Apache County Treasurer is Marleita Begay. Her office is at 75 West Cleveland in St. Johns, the same building as the assessor. Call (928) 337-7629 for tax questions. The treasurer sends out tax bills, takes payments, and keeps track of who paid. If you need a copy of your bill or want to check your payment history, this is the office to contact.

You can search your tax account and see what you owe on the Apache County Tax Account Search page. Enter your parcel number to pull up your record. The system shows the tax amount, due dates, and payment status. It also displays any past due amounts with interest. This is a good way to double-check your bill before you pay.

Property taxes in Apache County follow the same schedule as the rest of Arizona. The first half is due October 1. It goes delinquent on November 1 at 5 p.m. The second half is due March 1 and delinquent after May 1 at 5 p.m. You can pay the whole year by December 31 to avoid any late fees. If you miss a deadline, interest starts at 16% per year. That works out to about 1.33% per month. On a $1,000 tax bill, you would owe more than $13 extra each month you are late.

Pay Apache County Property Taxes Online

Apache County accepts online tax payments through Point and Pay. This lets you pay from home at any time. You do not have to mail a check or drive to St. Johns.

To pay online, go to the Apache County online payment portal. You will need your parcel number or tax account number. The system shows your balance due. You can pay by credit card, debit card, or electronic check. There are fees for each payment type. E-checks usually cost the least. Credit cards charge a percentage of your payment. Check the fee schedule before you pay so there are no surprises.

You can also pay in person at the treasurer's office during business hours. They take cash, checks, and cards at the counter. Mail payments go to the same address at 75 West Cleveland Street in St. Johns, AZ 85936. Make checks out to the Apache County Treasurer. Include your parcel number on the check so they apply it to the right account.

Apache County Property Tax Appeals

If you think your property value is too high, you can file an appeal. Start with the county assessor. You must file within 60 days after the Notice of Value is mailed. Use ADOR Form 82130 for real property. The assessor will look at your claim. They may agree and lower your value. If they do not agree, you get a written decision.

You can then appeal to the County Board of Equalization. File within 25 days of the assessor's decision. The board acts like a judge. They look at the facts and can change your value or property class. You can also skip the board and go to Tax Court within 60 days. Most people try the board first since it costs less and moves faster. The Arizona State Board of Equalization has more info on the appeal process and your rights.

Note: The board does not accept appeals by fax or email. Use the required forms.

Property Tax Exemptions in Apache County

Arizona law gives some property owners a break on taxes. Veterans with a 100% service-connected disability can get a full exemption on their home. This is a big deal for those who served. Other veterans with partial disability ratings may qualify for smaller exemptions. Widows, widowers, and people with total permanent disabilities also have options. The assessor handles exemption applications. Ask for the right forms at the office or check the state website.

The Senior Freeze Program helps older residents on fixed incomes. If you meet the age and income rules, you can lock in your property value for three years. Your taxes stay steady even if land prices go up. Use ADOR Form 82104 to apply through the Apache County Assessor. This program gives real peace of mind to seniors who worry about rising costs pushing them out of their homes.

What Apache County Tax Records Show

Property tax records in Apache County contain several types of data. The assessor side has ownership info, legal descriptions, and values. Building records show details on structures. You can see square footage, room counts, and when the home was built. Land records list the lot size and zoning. Sales history shows past transfers and prices paid.

The treasurer side focuses on money. Tax bills show how much is owed each year. Payment records track what has been paid and when. Delinquent records show unpaid taxes and interest. Lien data appears if taxes went unpaid long enough for the county to file a claim. Under Arizona law, unpaid property taxes create a lien that beats almost all other claims on the land. This means tax debt gets paid first if the property ever sells.

All of these records are public. Anyone can look them up. You do not need to own the property. You do not need to give a reason for your search. Under ARS 39-121, public records must be open for inspection during office hours. The online portals make this even easier since you can search from home any time of day.

Contact Apache County Tax Offices

Both the assessor and treasurer work out of the county complex in St. Johns. Here is how to reach each office.

Apache County Assessor: Rodger Dahozy, 75 West Cleveland Street, St. Johns, AZ 85936. Phone: (928) 337-7624. Hours: Monday through Thursday, 6:30 a.m. to 5:30 p.m. Closed Friday. The assessor website has forms and more info.

Apache County Treasurer: Marleita Begay, 75 West Cleveland, St. Johns, AZ 85936. Phone: (928) 337-7629. The treasurer website has payment info and links to online tools. If you plan to visit in person, call first to make sure the office is open. Hours can change around holidays.

Nearby Arizona Counties

Apache County sits in the northeast corner of Arizona. It shares borders with New Mexico to the east and the Navajo Nation to the north. If you own property near a county line or just want to compare records, these nearby county pages may help.

Navajo County lies to the west of Apache County. The county seat is in Holbrook. They also use the EagleWeb system for online records. Coconino County sits to the northwest. Their offices are in Flagstaff. Greenlee County is south of Apache County. Clifton is the county seat there. Each county has its own assessor and treasurer, but the tax rules follow the same Arizona state laws.