Casa Grande Property Tax Lookup

Casa Grande property tax records can be searched through Pinal County. The county assessor sets values on all land and buildings in the city. The county treasurer sends out bills and takes payments. You do not go to city hall for tax records. Everything is at the county level. Casa Grande is one of the largest cities in Pinal County with close to 60,000 residents. The county keeps parcel data, tax amounts, and payment history for every property in town. You can look up this data online for free. Just enter an address or parcel number to see your records.

Casa Grande Property Tax Quick Facts

Casa Grande Tax Records at Pinal County

The City of Casa Grande does not collect property taxes. This is how Arizona works. Cities set tax rates but do not bill or collect. Pinal County handles all of it. The county assessor finds every parcel in Casa Grande and sets its value. The county treasurer mails bills and collects payments. If you need your tax records, you go to Pinal County.

Pinal County has a satellite office right in Casa Grande. You do not have to drive to Florence, the county seat, for basic help. The local office can take tax payments and answer questions. The main county offices are in Florence at 31 N Pinal Street, Building E. But Casa Grande residents have easy access nearby. Call the treasurer at 888-431-1311 toll free or 520-509-3555 local. Email goes to treasurer@pinal.gov.

Casa Grande sets its own primary and secondary tax rates each year. The primary rate funds city services. The secondary rate pays for bonds and debt that voters approved. These rates only cover the city portion of your tax bill. Your full bill also includes rates from Pinal County, your school district, and any special districts like fire or flood control. All these rates add up to your total tax.

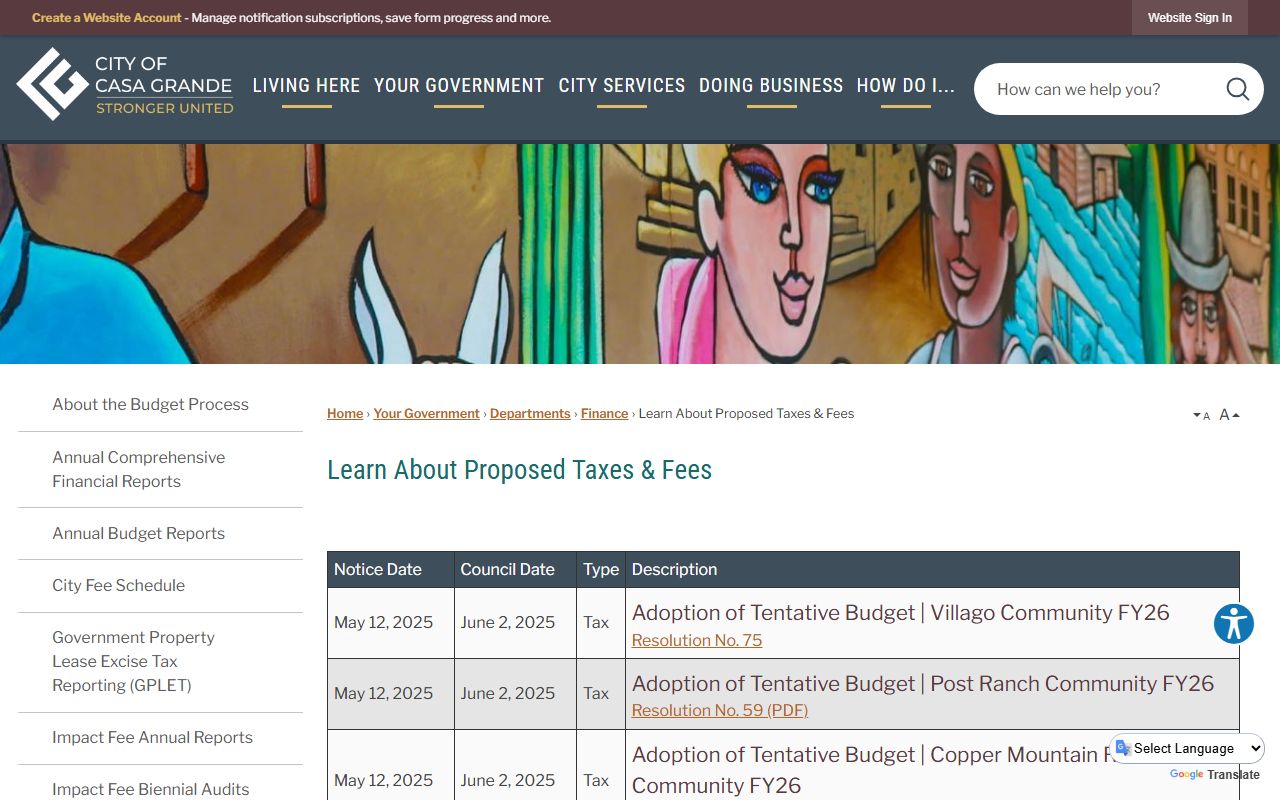

Casa Grande Property Tax Increase Proposal

Casa Grande has proposed a property tax increase for city residents. The city is proposing an increase in primary property taxes of $327,164, which works out to 7.39% more than the current level. When cities propose such increases, Arizona law requires them to hold a public hearing. This is called Truth in Taxation. Residents can attend and voice their views before the city council votes.

The City of Casa Grande proposed taxes page explains the increase and when public hearings take place.

Truth in Taxation notices break down the numbers. They show how much a typical home would pay under the new rates. The notices also explain what the extra money would fund. Common uses include city roads, parks, and public safety. Even a 7.39% jump in the city rate may not feel huge on your total bill since the city rate is just one piece. But it adds up over time. Reading the notice helps you know what to expect.

Note: The proposed increase applies only to the city portion of property taxes, not to county, school, or special district rates.

Search Casa Grande Tax Records Online

Pinal County offers free online tools to look up Casa Grande property tax records. The Parcel Inquiry tool on the treasurer site lets you search by parcel number or address. Results show who owns the land, how much tax is due, and payment history. You can see if taxes are current or past due.

The county also runs a broader Parcel Search system that pulls in assessor data too. This tool shows more detail. You get legal descriptions, lot dimensions, and building info. Sales history tells you what the property sold for and when. Maps show exact parcel lines. Both tools are free. No account needed. Just type in your search terms and go.

These online portals work any time of day. You can look up your bill at midnight if you want. The county updates records regularly so the data stays current. If you see something wrong, contact the assessor or treasurer to fix it. But for most people, the online search gives all the info they need without a phone call or office visit.

Pinal County Assessor for Casa Grande

Douglas Wolf serves as the Pinal County Assessor. His office sets the value of every Casa Grande property each year. The assessor mails a Notice of Value in February. This notice shows the Full Cash Value and Limited Property Value for your land and buildings. The limited value is what matters for your tax bill. It can only rise 5% per year under Arizona law. This cap keeps taxes from jumping too fast when home prices spike.

Contact the Pinal County Assessor at 520-866-6361 with value questions. The main office is at 31 N Pinal Street, Building E, in Florence. Assessor records include legal descriptions, lot sizes, building details, and sales data. You can use this info to compare your home to others nearby. This helps if you want to appeal your value.

If you think your assessed value is too high, you have 60 days from when the notice was mailed to file an appeal. Use ADOR Form 82130 for real property. The assessor reviews your claim and may agree to lower the value. If not, you can go to the County Board of Equalization or Tax Court. Appeals take time but can save real money if you win.

Pinal County Treasurer for Casa Grande

Michael P. McCord is the Pinal County Treasurer. His office handles all Casa Grande property tax billing and collection. Tax bills go out each September. The first half is due October 1 and goes delinquent after November 1 at 5 p.m. The second half is due March 1 and becomes delinquent after May 1 at 5 p.m. You can pay the whole year by December 31 if you prefer one payment.

The Pinal County Treasurer website lets you look up your bill and pay online. Enter your parcel number or address to find your account. The site shows current taxes due, past payments, and any delinquent amounts. Payment options include e-check, debit card, and credit card. E-check often has the lowest fees.

Late payments cost 16% interest per year. That is about 1.33% per month. On a $2,500 tax bill, one month late adds about $33. The longer you wait, the more it costs. If taxes stay unpaid past the following February, the county files a lien and advertises your property in the local paper. A tax lien gives the county first claim on your land until you pay. Avoid this by paying on time.

Casa Grande Tax Payment Deadlines

Property tax in Casa Grande follows the same calendar as all of Arizona. Bills arrive in September. Then comes payment time. You can split it in two or pay all at once.

Key dates to know:

- October 1: First half taxes due

- November 1 at 5 p.m.: First half goes delinquent

- December 31: Last day to pay full year without interest

- March 1: Second half taxes due

- May 1 at 5 p.m.: Second half goes delinquent

One rule catches some people off guard. If your total tax for the year is $100 or less, you must pay it all by October 1. No splitting into halves. This keeps the county from spending more on paperwork than it collects. Most Casa Grande homes owe more than $100, so the two-payment option works for most folks.

Casa Grande Property Tax Exemptions

Arizona offers several tax breaks that Casa Grande residents can use. Veterans with a 100% service-connected disability get a full exemption on their primary home. This took effect January 1, 2026. Other veterans with lower disability ratings may qualify for partial relief. Widows, widowers, and people with total permanent disabilities can also apply.

The Senior Freeze Program helps older homeowners on fixed incomes. If you meet the age and income rules, your property value locks in for three years. Your taxes stay flat even when home prices rise around you. Apply through the Pinal County Assessor using ADOR Form 82104. This program gives real relief to seniors worried about rising costs pushing them out of their homes.

Exemptions do not happen automatically. You must apply. Contact the Pinal County Assessor at 520-866-6361 to find out if you qualify. Miss the deadline and you wait another year. If you think you might qualify, ask sooner rather than later.

Note: Exemptions reduce your assessed value or tax amount but do not eliminate all property taxes for most people.

Property Tax Appeals for Casa Grande

You can challenge your property value if you believe it is set too high. The appeal process starts with a petition to the Pinal County Assessor. Use ADOR Form 82130 for real property. You must file within 60 days of the date on your Notice of Value. Personal property owners get only 30 days.

The assessor reviews your appeal and may agree to lower the value. If not, you have more options. File with the Pinal County Board of Equalization within 25 days of the assessor's decision. The board acts like a judge. They look at your evidence and the county's evidence, then decide what value is fair. You can also skip the board and go straight to Arizona Tax Court within 60 days of the assessor's decision.

To win an appeal, bring evidence. Get comparable sales data from the county records. Find homes like yours that sold for less than your assessed value. Take photos if your property has problems the assessor might not know about. The more proof you bring, the better your odds. Even if you do not win a full reduction, you might get some relief.

Nearby Arizona Cities

Casa Grande sits in central Pinal County along Interstate 10. Several other cities and towns are nearby. All use Pinal County for property tax records. If you own land in more than one Pinal County city, your bills still come from the same county office. Only the tax rates change based on which city and school district serve each parcel.

Cities near Casa Grande in Pinal County:

Apache Junction, San Tan Valley, Coolidge, and Florence are also in Pinal County. Queen Creek spans both Pinal and Maricopa counties, so some residents there deal with Pinal offices while others go to Maricopa County. All Pinal County cities use the same treasurer and assessor. Your tax records stay in one place no matter which city you live in.

Pinal County Property Tax Resources

For more details on property taxes in Casa Grande and the surrounding area, visit the Pinal County property tax page on this site. That page covers the assessor and treasurer offices in depth. It lists contact info, office hours, and online search tools. It also explains tax rates, appeals, and exemptions at the county level.

Pinal County has five office locations across the county. The main hub is in Florence. Satellite offices in Apache Junction, Casa Grande, Maricopa, and San Tan Valley serve local residents. The Casa Grande office makes it easy to handle tax business without a long drive. You can pay bills, ask questions, and get forms right in town.